How can fund investors use intelligent solutions to simplify the allocation decision-making process? In our latest article, AlternativeSoft explores how our bespoke portfolio construction solutions empower simplify allocation decisions with award-winning analytics.

In this article we will evaluate the usefulness of the Ulcer Index and Serenity Ratio when selecting funds. We will first explain the two metrics and how are they related and then evaluate to what extent Serenity Ratio can outshine the Sharpe Ratio when selecting best performers.

Market-neutral funds are actively managed to be independent from both upward and downward market movemements. Usually, this is achieved through the use of paired long and short positions. These funds can potentially serve to mitigate market risk as they seek to generate positive returns in all market environments.

As investors watch the Asian markets, we take a closer look at Chinese real estate. AlternativeSoft allows investors to ascertain fund exposure levels and decompose portfolio risk and return to help mitigate the impact of such events on institutional portfolios.

Style analysis is widely used in the Alternatives Industry to estimate the exposure of less transparent funds. To explain fund return streams, there is a commonly used regression technique called Ordinary Least Square (OLS). In this article, learn about the issue of Heteroskedasticity, how to account for it in OLS analysis and modeling.

Can investors maintain a well diversified portfolio, even during crisis periods? In this article, AlternativeSoft measures the impact of the Covid-19 pandemic on the correlation of hedge fund index returns. Which strategies maintained the lowest correlation to other indices throughout the crisis?

Mean return and variance measures are fundamental to analysing hedge funds. But in which scenarios is it more prudent to introduce higher-moment models such as co-skewness and co-kurtosis to inform your investment decisions?

In this article, we analyse if skewness can be a useful indicator of future performance for North American mutual funds.

We categorise the skewness of returns of 1,200 Equity based Mutual Funds into 6 portfolios, based on their performance between 2000 and 2010.

In this article we look at equity returns and the returns of top performing US equity Mutual Fund to show that increasing yields has a tangible effect on equity and mutual fund performance. We also show that by holding the top 10 invested stocks for this fund you can out-perform the entire portfolio.

We find that Edale Europe Absolute Fund has been the best performing European Hedge Fund after the COVID-19 Financial shock that took place in March 2020. In this article we rank European Hedge Funds by their cumulative returns between April 2020 and March 2021.

The Rachev ratio provides an alternative measure for an investment's risk-return performance by dividing the average of right tail returns by the average of left tail returns at given percentiles equidistant from the mean. In this article AlternativeSoft evaluates whether the Rachev Ratio can be used to avoid significant drawdowns.

We selected Hedge Funds with AUM greater than $10 Million, with an investment geography focus in China and United States.

59 funds from China and 210 funds from the United States got selected for the analysis on which a weighted index was created based on the hedge funds’ AUM.

We find that Hedge funds investing in Crypto have had the highest Annual Sharpe Ratio between 1st of March 2020 and 31st of March 2021. AlternativeSoft analysed and compared 1563 Hedge Funds of the NilssonHedge database between the time period 1st March 2020 to 31st March 2021.

In this article we look at equity returns and the returns of top performing US equity Mutual Fund to show that increasing yields has a tangible effect on equity and mutual fund performance. We also show that by holding the top 10 invested stocks for this fund you can out-perform the entire portfolio.

This brief article examines the five best performing Hedge Funds and the five best performing Mutual Funds from April 2020 to December 2020. The sole focus was placed on hedge funds and mutual funds that have AUM > USD100m.

Bridgewater Associates is the world’s biggest hedge fund. Founded in 1975 by Ray Dalio , it grew exponentially throughout the decades, and it now serves individuals, institutions, trusts, private funds, charitable organizations, and investment companies offering portfolio management...

We selected 32 hedge funds with an Annual Sharpe Ratio greater than 4 during the period Jan2010-Feb2020and with at least $10M of assets under management.

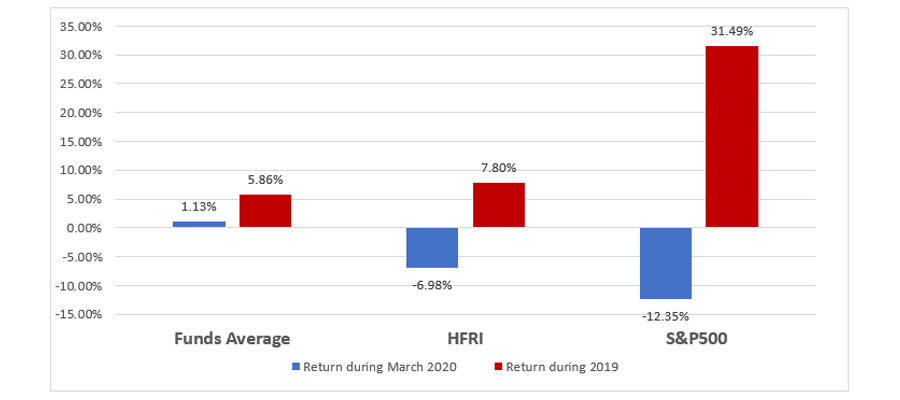

This analysis uses 836 CTA (Commodity Trading Advisor) Hedge Funds and compares their returns in March 2020 and for the year 2019. Data for these funds are provided by NilssonHedge, EurekaHedge and HFR.

As the industry witnesses fading differentiations between long-only, private equity and hedge funds, investors are starting to purchase software and databases.

Does investment in an active manager provide better drawdown protection than investment in the market?

Was 2018 really as bad a year for Hedge Funds as most market commentators have suggested and, if so, which strategies would have been best insulated from the turbulence?

Can we find outperformance using an algorithmic asset selection approach which focuses on lesser used risk and return statistics?

We interviewed Don Steinbrugge from Agecroft Partners and asked him some questions regarding the economy, coronavirus and conferences.

After a difficult few months due to the pandemic, Year-to-date, only 4 hedge fund sectors were in the black for April, including....

S&P 500 index rose far above benchmark gauges in Asia.

As the Covid-19 pandemic shows the earliest signs of drawing to a close, there are split opinions among hedge funds regarding what the next move should be.

PE firms sitting on $1.5tn to be used for “market dislocation”

Millions sent home as 3 hedge funds still manage to outperform market sell-off

Many believe Platt is the highest earning person in finance

A Danish hedge fund by the name of Asgard Credit is shorting Tesla bonds

Is machine learning beginning to take centre stage?

Greg Jensen Co-CIO believes these 3 reasons will cause gold to rise

Conrad and Shilling’s top ten mutual funds list (With associated five-year returns)

Less than 9,000 hedge funds now exist globally

Singapore is home to two of the top ten HF in 2019

Airbus, Moody’s, Charter Communications and more have been warned by TCI

Fears grow as assets held by private equity firms grows 83% in past decade

Founder and Billionaire Ray Dalio takes to social media to contest WSJ

Top 10 most loved stocks from 833 top hedge funds

Money being left on the table for player likeness, use of names and more

Switching from a partnership to a corporation has served many private equity firms very well.

For most firms’ women hold just 1 or 2 of the top positions on the buyout investment teams

Secondary deals have already broken 42bn for the first semester of 2019

The European Central Bank has lowered its deposit rate by 10 basis points as Draghi looks to step down next month

Sorrell to take up a senior role at rival asset management firm

$400m for majority stake in one of India’s largest education service providers EuroKids

Two private equity companies are looking to co-own the makers of Norton Anti-Virus software

180% stake increase makes gold hedge funds biggest held position

Soaring temperatures leads to 60% increase in carbon-emissions credits

Some firms have raised billions to take general partner stakes in other private equity players.

Berlin based ratings company “Scope” found that Multi-asset funds that invest directly in securities outperformed fund-of-funds over a 10-year period.

Franklin Templeton and Hasenstab dividing global opinion with latest bet

Some firms have raised billions to take general partner stakes in other private equity players.

Top 5 buys and sells from the world’s biggest hedge funds

Traders have dumped riskier assets such as stocks and crude oil moving towards “safe havens assets” including bonds.

Reports of hedge funds pushing for brexit have been rubbished by multiple sources.

GPIF want to make the market more sustainable not beat it.

Gold has risen 18% this year making it a refuge for hedge funds.

ABG is critical first deal for BlackRock as they continue to fundraise with target of $12b for LTPC fund.

After the antics of Abraaj Group investors have been reluctant to seek other opportunities in this region of the world.

Funds which rely more on insider money outperform funds that use asset gathering.

Disney Plus, Hulu and ESPN for the same price as Netflix suggests direct attack.

Only one new hedge fund has managed to reach $2b this year, $6b shy of last year’s highest total.

Investors are gambling on further falls in share price.

Carlyle look to improve share price with inclusion in index tracker funds.

Sterling falls to 2 and half year low as no-deal Brexit becomes real possibility.

Society is on the precipice of major shifts in wealth, energy sources and morality, could ESG investing turn the heads of hedge fund managers?

85% loss of partners money after energy stocks have a tough year. Energy fund Equinox Energy has announced its plans to close their fund after 4 and a half years of torment losing 85% of their partners money.

10 Lower Thames, London

EC3R 6AF

+44 20 7510 2003