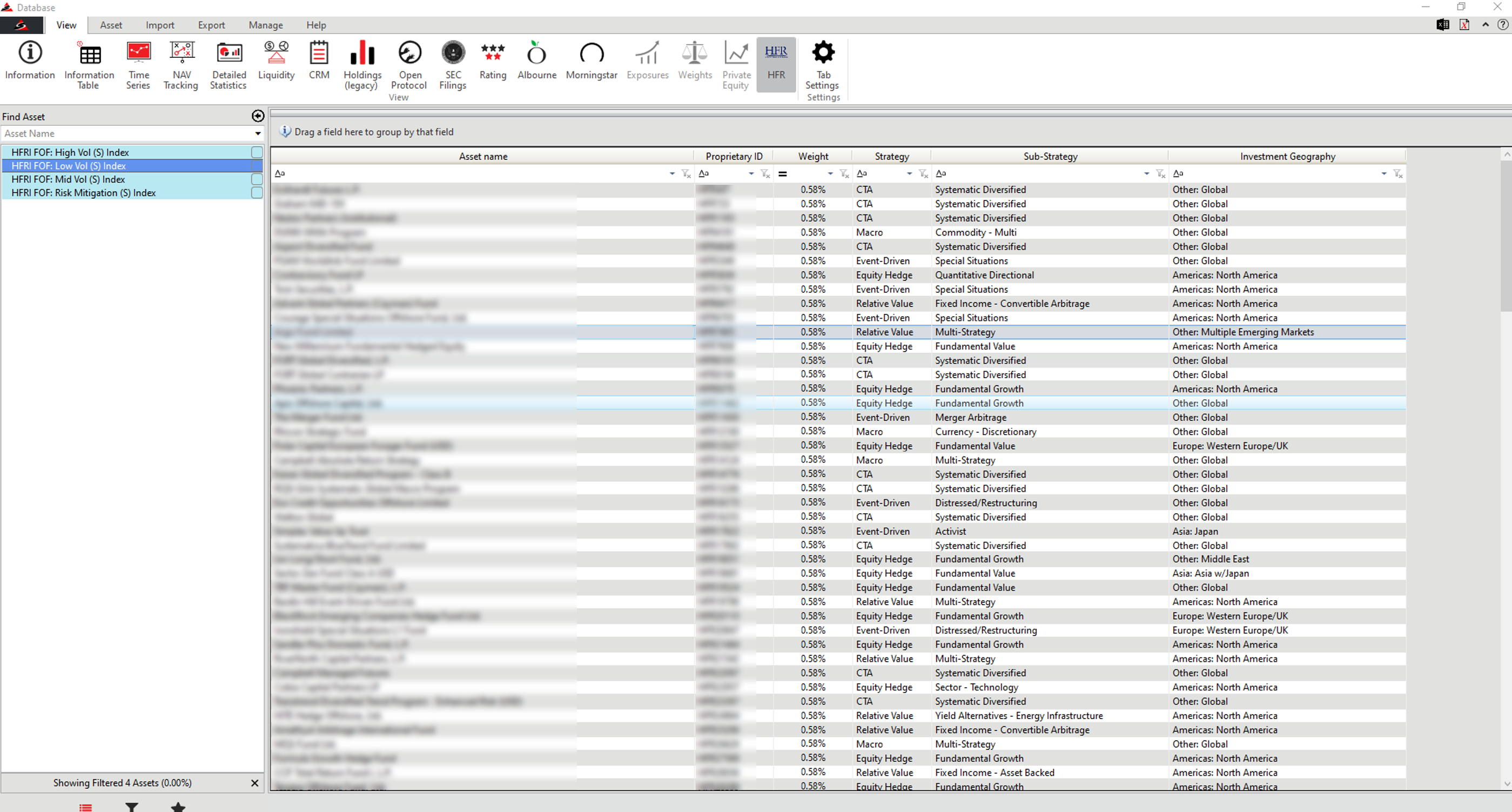

HFRI FOF (Synthetic) Indices

HFRI FOF (Synthetic) Indices are comprised of funds that are constituents of the HFRI 500 Index and are designed to synthetically (S) represent the performance of Low, Mid or High volatility fund of funds.

The following indices are supported:

- HFRI FOF: Low Vol (S) Index

- HFRI FOF: Mid Vol (S) Index

- HFRI FOF: High Vol (S) Index

- HFRI FOF: Risk Mitigation (S) Index

AlternativeSoft now allows users to view these indices within the application. Users can see the performance, constituents, and constituent weights. This provides a fantastic opportunity for allocators to benchmark not only performance but also strategic weights; enabling a unique drill down into which strategies outperformed.

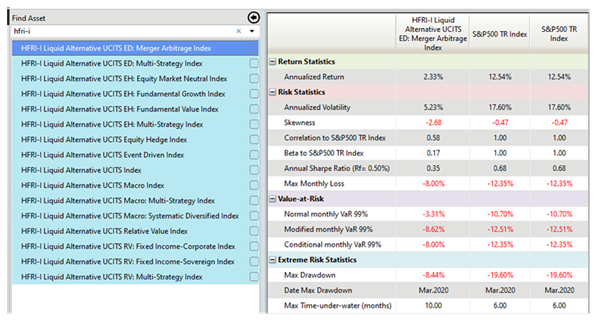

HFRI-I Liquid Alternative UCITS Indices

The HFRI-I Liquid Alternative UCITS Indices are performance benchmarks comprised of liquid alternative investment strategies compliant with established UCITS guidelines.

AlternativeSoft now allows users to view these indices within the application. Users can see the performance & constituents.

Morningstar funds

AlternativeSoft delivers:

- Mutual funds top 10 holdings.

- Customisable mutual fund fact sheets on any funds.

- Easy to use peer grouping.

- More than 400,000 funds to choose from.

- More than 50 Morningstar strategies (small caps, growth funds, Asia funds with AUM >500m and many more).

Download your Sample Factsheet

Our Awards

Explore Our Knowledge Center

Delve into our Knowledge Center for valuable resources, including brochures, case studies, and research articles, designed to enhance your understanding of the investment landscape.

Featured Content

Investment Due Diligence with AlternativeSoftExplore our Investment Due Diligence brochure to learn about our rigorous methodologies and how we can help you make well-informed investment decisions.

Read More!Case Study

Swiss Family Office Case StudyDiscover how our tailored solutions helped a Swiss Family Office achieve their financial goals and gain a competitive advantage in today's complex investment landscape.

Read More!Applied Research

By AlternativeSoft Hedge Fund Industry's 2024 Capital Flows Reveal Surprising Shift Away from 20 Largest Hedge FundsThe hedge fund industry experienced a total net outflow of $37.1 billion in 2024, adjusted for the positive 2024 returns, but a deeper analysis reveals an unexpected pattern in capital movements that challenges conventional wisdom about investor preferences.

Read More!Office Location

UK: 10 Lower Thames Street, London

EC3R 6AF

USA: 200 South Wacker Drive, 31st Floor,

Office 3214, Chicago, IL 60606