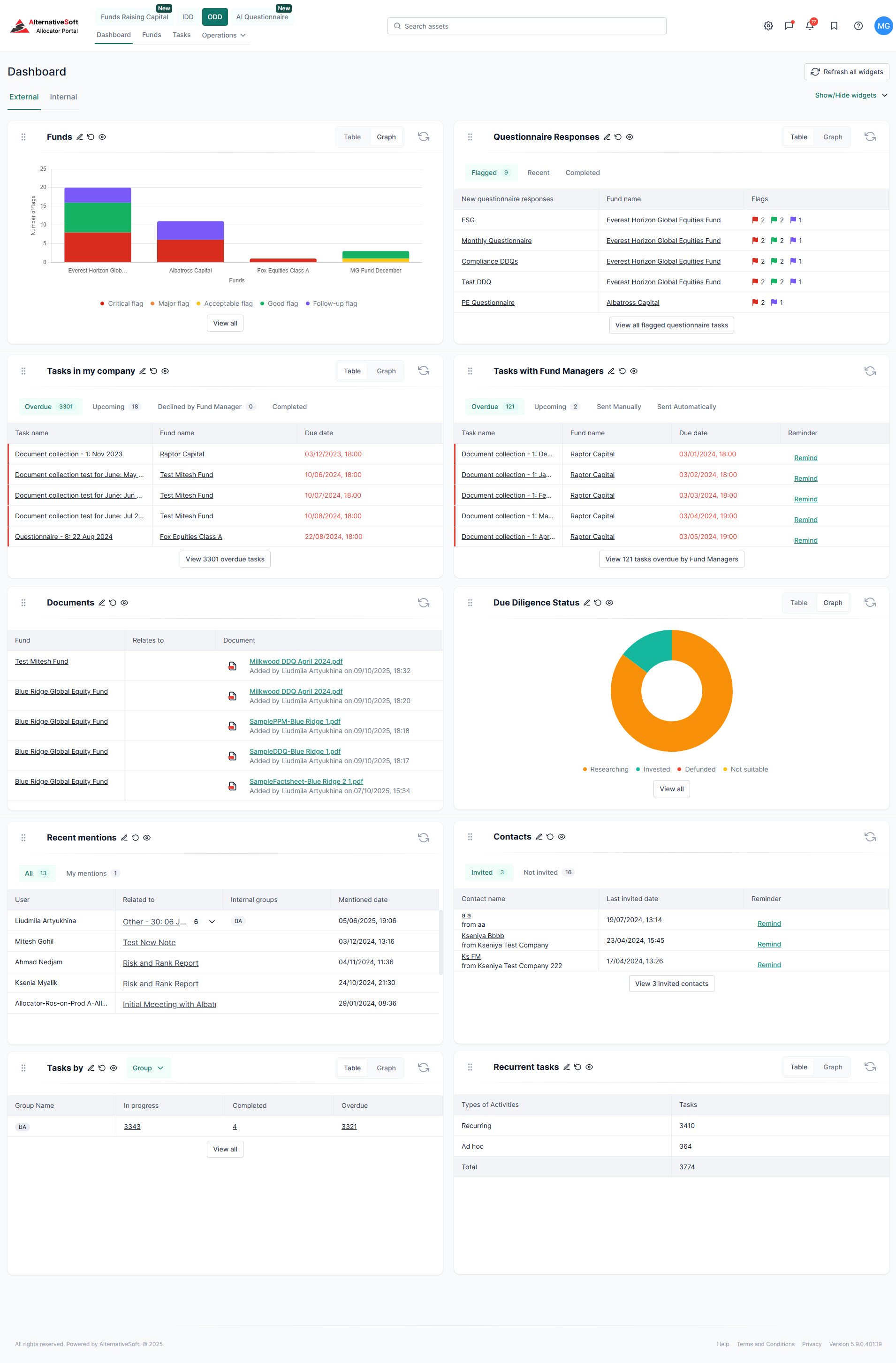

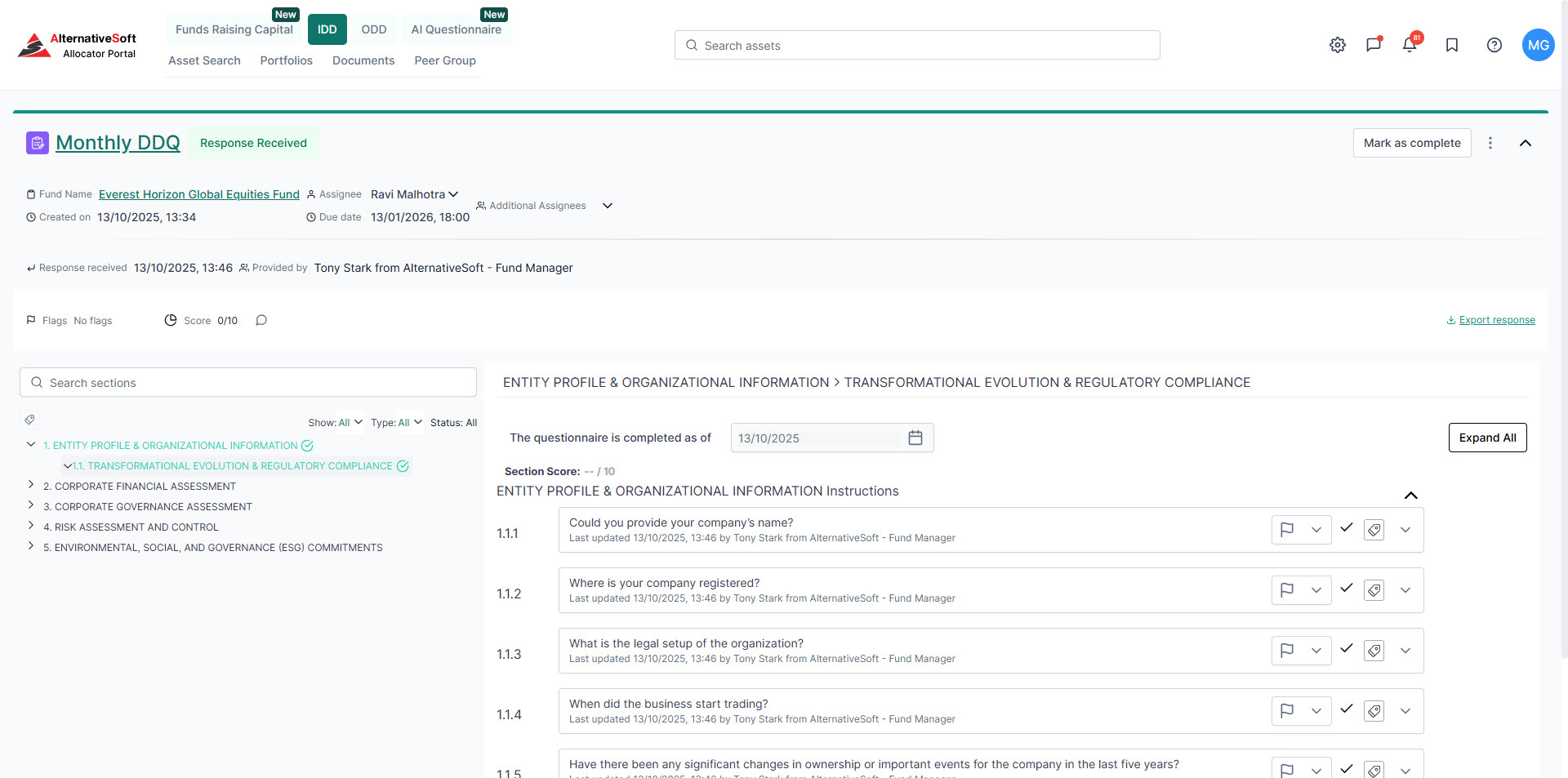

The Complete Due Diligence Platform for Allocators Investing in Hedge Funds

Complete DDQs and RFPs instantly with AI trained on your fund documents and past responses. Reduce manual effort by 90%.

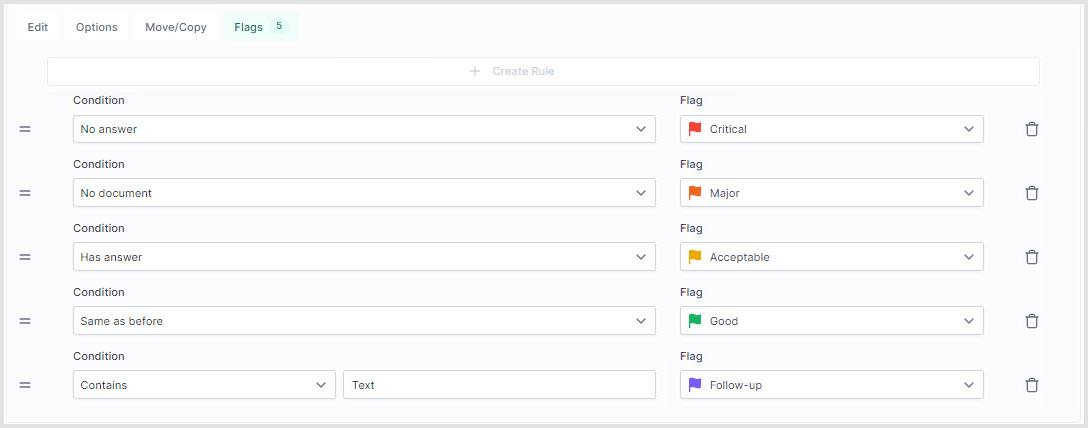

Automatically flag potential compliance issues in questionnaire responses. Ensure regulatory adherence at every stage.

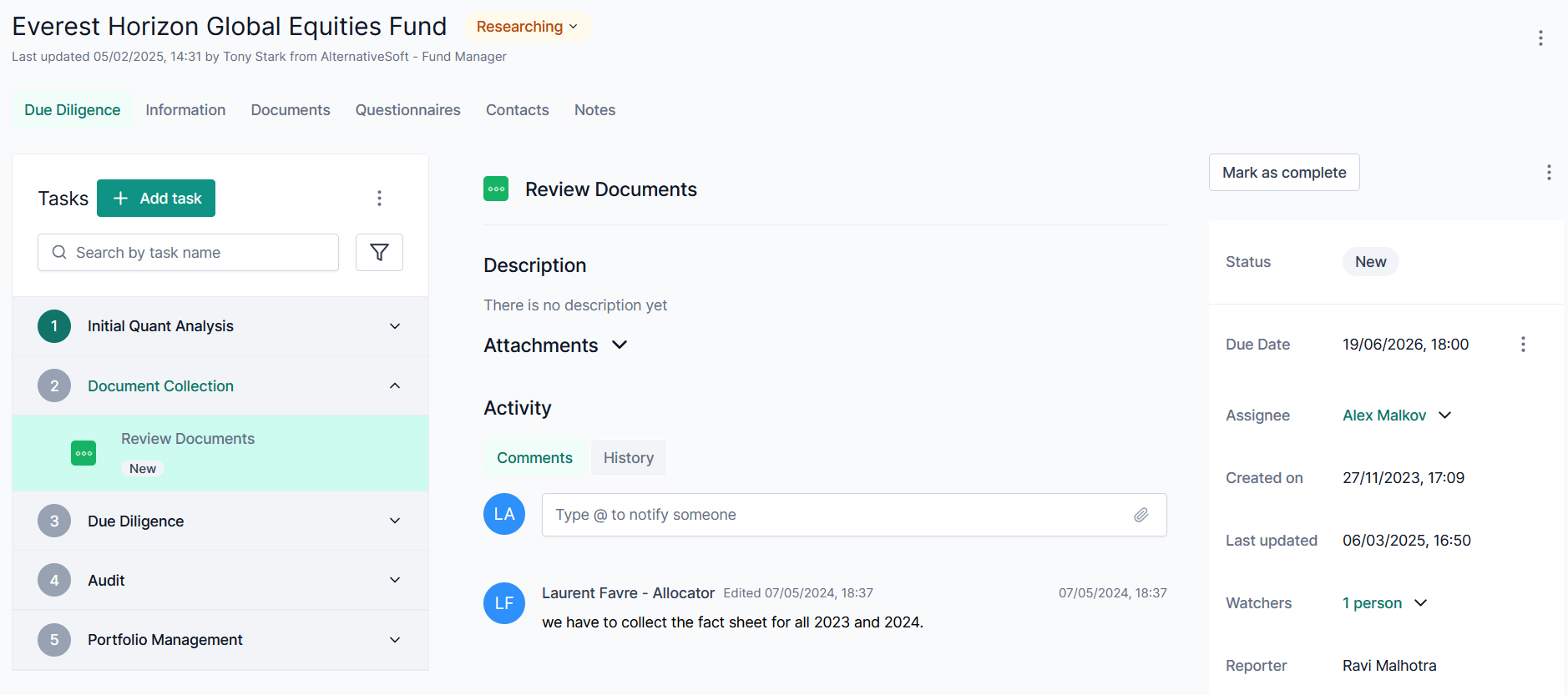

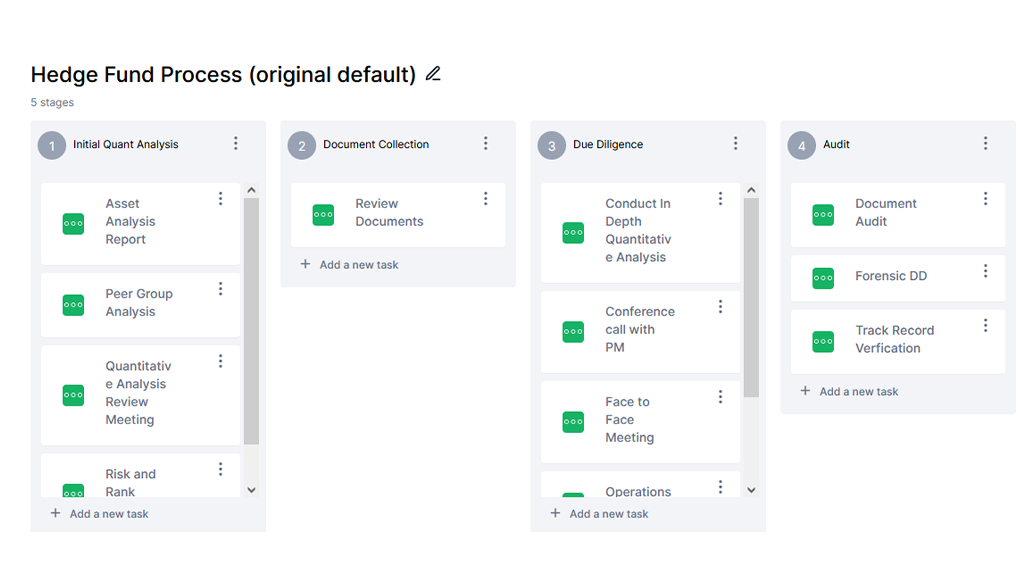

Access all returns, documents, questionnaires, and meeting notes in one secure hub. Streamline workflows and enhance collaboration.

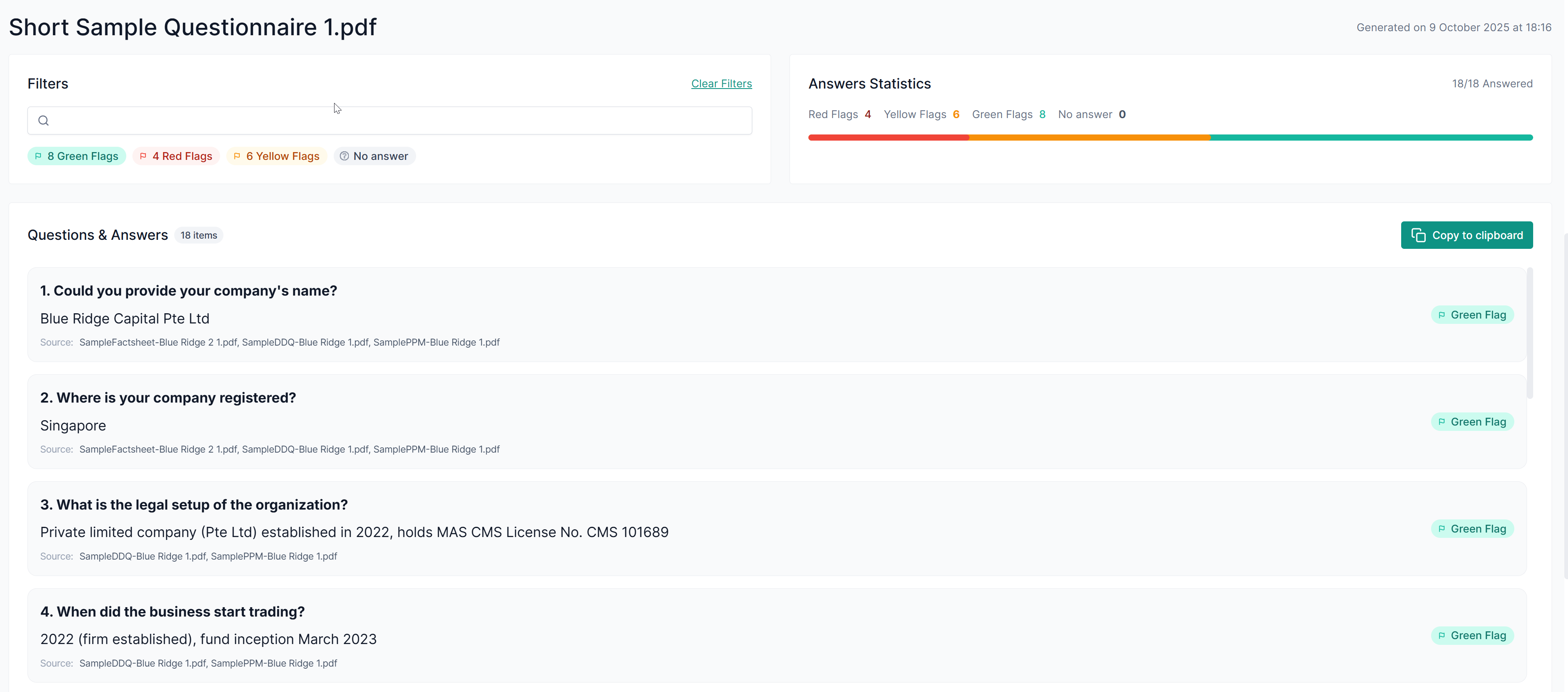

AI-Powered Questionnaire Completion

Transform weeks of work into minutes

-

Instant DDQ Completion: AI reads and completes allocator due diligence questionnaires automatically using your fund documents and historical responses.

-

90% Time Savings: What used to take weeks now takes minutes. Free your team to focus on analysis and decision-making.

-

Smart & Accurate: Context-aware AI delivers tailored responses that match each question's intent and your firm's standards.

-

Full Control: Review, edit, and approve all responses before submission. Maintain your quality standards whilst accelerating workflows.

-

Compliance-Ready: AI-generated responses align with regulatory requirements and internal policies from the start.