Blogs | Related News | Software Updates | Company Updates | Events | Awards

Blogs

The Four Allocator Demands Defining Hedge Fund Capital in 2025 — and How Managers Can Stand Out

The allocator landscape in 2025 looks very different from even two years ago. The era of easy inflows driven purely by performance is behind us. Institutional allocators — from pension funds to family offices — are redefining what they expect from hedge funds.

The VIX Just Dropped — Here’s Why I’m Buying Back Into Equities

Two days after our previous post, where I warned investors about elevated volatility and urged caution, the market sent us a new signal. As of 18 October 2025, the VIX — Wall Street’s volatility index — has fallen from 26 to 20.

European Investors Continue to Fuel Sustainable Funds — Here’s How Fund Managers Can Attract Similar Capital

Ecosystem Investment Partners (EIP), a US-based private equity firm focused on large-scale ecological restoration, has successfully closed its fifth fund with over $400 million in commitments — a testament to the growing European appetite for sustainable and nature-based investments.

The State of Hedge Fund Capital Raising in 2025: Navigating Digital Transformation and Institutional Demand

2024 concluded with record capital flows into alternative assets, and 2025 is shaping up to be another strong year for single-manager hedge funds. Long/short equity strategies have continued their dominance, but institutional investors are increasingly seeking diversified approaches.

Hedge Fund Capital Nears $5 Trillion — Here’s How Smaller Managers Can Compete for Allocations

Marketing hedge funds to allocators has traditionally involved conferences, databases, and networking events. A digital marketing platform changes the game by making the process direct, efficient, and measurable.

Venture Fundraising Hits Lowest Level Since 2017 — Why Visibility With Allocators Matters More Than Ever

Venture capital fundraising in the first half of 2025 has hit its weakest point in nearly a decade, according to Venture Capital Journal. Firms raised $41.6 billion worldwide in H1 2025 — the lowest since H1 2017 and well below the $105 billion raised just three years earlier.

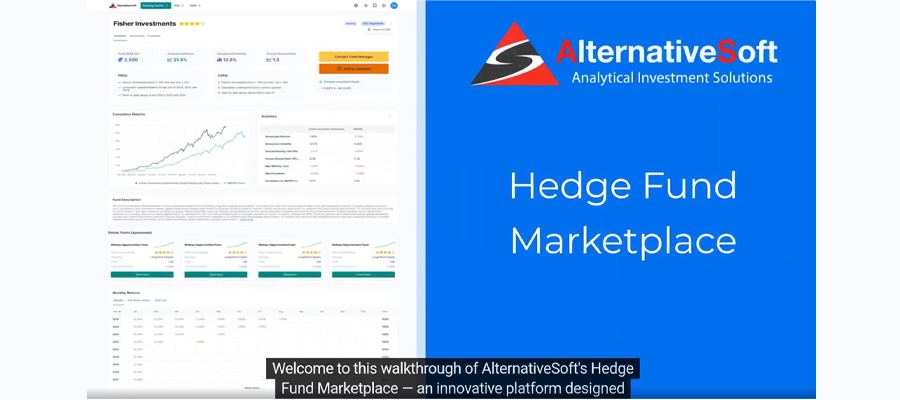

Platform for Allocators Selecting Funds & Hedge Funds Raising Capital

The capital-raising process works both ways: hedge funds need investors, and allocators need suitable funds. Platforms that serve both sides create real efficiency.

Platform for Marketing Hedge Funds to Allocators

Marketing hedge funds to allocators has traditionally involved conferences, databases, and networking events. A digital marketing platform changes the game by making the process direct, efficient, and measurable.

Promote My Hedge Fund to 150+ Institutional Investors

Fundraising is all about visibility. Without access to the right network, even strong-performing funds can struggle to attract capital. What if you could showcase your hedge fund to over 150 institutional investors in one place?

AI-Powered Hedge Fund Marketplace to Reach Institutional Allocators

Raising capital is one of the biggest challenges hedge fund managers face. Traditional networking and capital-raising events are expensive and time-consuming. An AI-powered marketplace now makes it easier to connect directly with allocators.

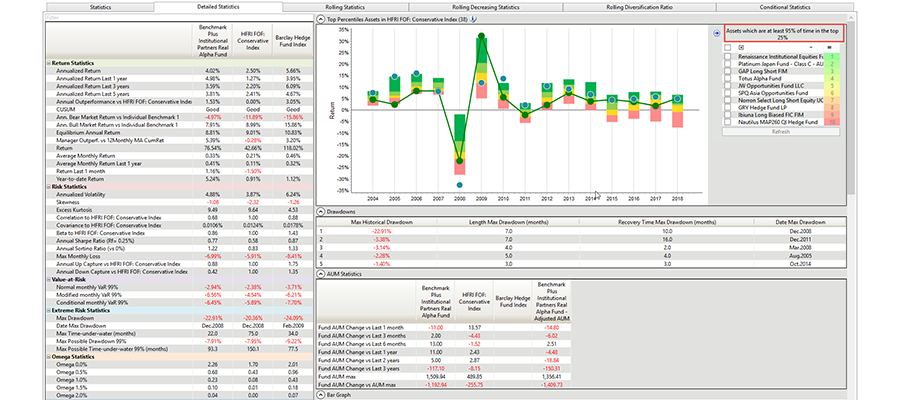

Best Software for Aggregating Fund Data from Morningstar, Preqin, Bloomberg

Most asset managers rely on multiple data feeds. But combining Morningstar’s mutual fund data, Preqin’s private equity insights, and Bloomberg’s hedge fund coverage is no small feat.

How to Access a Unified Database of Hedge Funds, Mutual Funds, and Private Equity

Institutional investors often struggle with fragmented data. Hedge fund performance might be on one platform, while mutual fund data lives elsewhere, and private equity information requires another subscription. The result? Lost time, higher costs, and inconsistent analytics.

Embracing AI in Investment Strategies: The Future of Portfolio Management

In the rapidly evolving financial landscape, Artificial Intelligence (AI) is revolutionizing portfolio management. Investment professionals are increasingly integrating AI-driven tools to enhance decision-making, optimize asset allocation, and manage risks more effectively.

AlternativeSoft: Your All-in-One Investment Solution

Investment professionals today face a significant challenge—juggling multiple software solutions for data aggregation, fund due diligence, reporting, and risk analysis. This fragmented approach is not only inefficient but also costly and time-consuming.

Navigating Market Volatility: Strategies for Resilient Portfolios

In an era where economic landscapes are continually shifting, sovereign wealth funds stand as resilient pillars, navigating through global uncertainties with strategic investments. As the world evolves, these funds are increasingly turning to innovative solutions to optimize returns and mitigate risks. In this blog post, we delve into the dynamic realm of sovereign wealth fund solutions, exploring how these entities adapt to a changing financial landscape.

Strategic Insights: How Macro Strategy Software Transforms Financial Decision-Making

In the fast-paced world of finance, staying ahead of the curve is imperative for success. Financial professionals and investment managers are constantly seeking ways to gain a competitive edge, and one powerful tool that has emerged to meet this demand is macro strategy software.

Mastering Risk Analysis: A Guide to Quantitative Modeling Techniques

In today's dynamic business landscape, mastering risk analysis is essential for informed decision-making and sustainable growth. With the increasing complexity of financial markets and the unpredictability of global events, businesses are turning to quantitative modeling techniques to gain deeper insights into potential risks and opportunities. At the forefront of this approach is quantitative risk modelling solution.

Global Perspectives: Sovereign Wealth Fund Solutions in a Changing Landscape

In an era where economic landscapes are continually shifting, sovereign wealth funds stand as resilient pillars, navigating through global uncertainties with strategic investments. As the world evolves, these funds are increasingly turning to innovative solutions to optimize returns and mitigate risks. In this blog post, we delve into the dynamic realm of sovereign wealth fund solutions, exploring how these entities adapt to a changing financial landscape.

Maximizing Returns: A Deep Dive into Alternative Investments with AlternativeSoft

In today's dynamic financial landscape, traditional investment avenues may not always yield the desired returns. Savvy investors are increasingly turning to alternative investments to diversify their portfolios and enhance performance. As the demand for these non-traditional assets grows, the need for sophisticated analytics platforms becomes paramount.

Mastering Your Investments: A Comprehensive Guide to Using Investment Analytics Tools

In the rapidly evolving landscape of finance, mastering your investments requires more than just intuition; it demands a data-driven approach powered by cutting-edge technology. This comprehensive guide explores the transformative role of investment analytics tools in optimizing portfolios, mitigating risks, and achieving superior returns.

Future Proofing Your Pension: The Role of Analytics in Fund Management

In an era of rapid technological advancements, the landscape of pension fund management is undergoing a transformative shift. As individuals plan for their retirement, it becomes increasingly essential to embrace innovative tools and strategies that can ensure the long-term sustainability and growth of pension funds.

From Data to Decisions: The Role of Analytics in Private Wealth Management Software

In an era where data reigns supreme, the world of private wealth management is undergoing a transformative shift. Traditional approaches are giving way to innovative solutions that harness the power of data analytics to inform critical investment decisions. The rise of Private Wealth Management Software, with AlternativeSoft at the forefront, is reshaping the landscape, allowing wealth managers to seamlessly navigate complex markets and empower their clients with insightful decision-making tools.

The Metrics That Matter: Understanding Impact Investment Performance

Impact investing has gained significant traction in recent years as investors seek not only financial returns but also positive social and environmental outcomes. As individuals and institutions increasingly align their investments with their values, understanding the performance metrics of impact investments becomes crucial.

Mastering Investment Insights a Deep Dive Into Portfolio Analysis Tools

In the dynamic world of finance, making informed investment decisions is crucial for success. As investors seek ways to maximize returns while aligning with sustainable and impactful strategies, the role of portfolio analysis tools becomes increasingly significant. In this blog, we'll explore the importance of mastering investment insights through a deep dive into portfolio analysis tools, with a spotlight on how AlternativeSoft is contributing to this transformative landscape.

Unlocking Success: How Investment Compliance Software Can Transform Your Strategy

In the ever-evolving landscape of finance, staying ahead of regulatory requirements is crucial for success. This is where Investment Compliance Software plays a pivotal role, enabling investors to navigate complex regulations seamlessly and optimize their strategies. One prominent player in this space is AlternativeSoft, revolutionizing the way investment performance is impacted and strategies are transformed.

Streamlining Success: A Guide to Private Wealth Management Software Solutions

Within the dynamic realm of financial management, private wealth management stands out as a crucial element in securing financial prosperity for high-net-worth individuals and families. As financial portfolios grow in complexity and the demand for immediate insights intensifies, the importance of private wealth management software has reached unprecedented levels.

Sustainable Investing for Endowments: Balancing Returns and Impact

The integration of Environmental, Social, and Governance (ESG) principles into endowment management heralds a new era of investing. Explore how sustainable investing aligns with financial goals while fostering positive societal and environmental change, redefining the role of endowments in creating a sustainable future.

Risk Management Strategies for Family Offices: Protecting Wealth Across Generations

For family offices entrusted with safeguarding generational wealth, effective risk management is paramount. Explore comprehensive strategies and methodologies designed to shield wealth from potential risks while ensuring its preservation and growth across multiple generations.

Optimizing Investment Due Diligence: A Holistic Approach for Financial Institutions

Investment due diligence forms the bedrock of sound financial decision-making for a spectrum of institutions—from endowments and pension funds to hedge funds and wealth managers. Discover a comprehensive framework that streamlines operational due diligence, offering a roadmap for informed investment decisions across various sectors.

Navigating Market Volatility: Strategies for Hedge Fund Investments

In the unpredictable world of finance, market volatility is a reality. For hedge funds, mastering strategies during these uncertain times is key to success. Explore the proactive approaches and tactical maneuvers that hedge funds can employ to not just survive but thrive amidst market turbulence.

Private Equity Trends: Evolving Investment Strategies in 2023

Private equity continues to evolve, adapting to new market dynamics and opportunities. Delve into the latest trends shaping the private equity landscape in 2023, uncovering emerging strategies, sectors of interest, and the impact of market shifts on investment decisions.

The Future of Asset Management: Technology's Role in Portfolio Optimization

Hedge fund managers operate in a dynamic and competitive industry. To achieve success, it's vital to employ effective strategies that set you apart. In this blog post, we'll explore key strategies and insights for hedge fund managers to navigate growth and achieve long-term success.

Maximizing Returns for Pension Funds: A Smart Investment Strategy

In an era of economic uncertainty, pension funds face a unique set of challenges. To ensure the financial security of retirees, pension fund managers must navigate volatile markets while delivering consistent returns. In this blog post, we will explore the key considerations and strategies to maximize returns for pension funds.

The Future of Portfolio Management with AI

The investment landscape is evolving. As an increasing number of Family Offices and other institutional investors seek to optimize their portfolio management strategies, many are turning to artificial intelligence (AI) as a powerful tool for achieving superior performance.

Navigating Success in Hedge Fund Management: Key Strategies for Growth

Hedge fund managers operate in a dynamic and competitive industry. To achieve success, it's vital to employ effective strategies that set you apart. In this blog post, we'll explore key strategies and insights for hedge fund managers to navigate growth and achieve long-term success.

Software Solutions for Family Offices

Family offices operate at the intersection of wealth management, investments, and legacy planning. Discover how cutting-edge software solutions can streamline operations, enhance performance, and safeguard your family's financial future.

Institutional Investment Management Software for Endowments

Endowments serve as financial pillars for institutions, supporting long-term goals and sustainability. Explore how advanced software solutions can optimize investment management for endowments, ensuring their continued growth and impact.

Due Diligence in Fund Management: Best Practices

Successful fund management begins with rigorous due diligence. Explore the best practices that underpin informed decision-making, risk management, and the pursuit of superior returns.

Institutional Investors: Strategies and Insights

Institutional investors play a pivotal role in the world of finance. Delve into the strategies and insights that drive success for institutions managing large portfolios.

Data Aggregators in Finance: A Comprehensive Guide

In the digital age of finance, data is the lifeblood of informed decisions. Explore the world of data aggregators and how they revolutionize the way financial information is gathered, analyzed, and utilized.

Regression Analysis for Hedge Fund Exposures

Unlock the power of regression analysis in understanding and managing hedge fund exposures. Explore how this analytical technique can provide valuable insights into your investment portfolio.

Private Equity vs. Hedge Fund: Deciphering the Distinctions

In the realm of alternative investments, the lines between private equity and hedge funds can be blurred. Dive deep into their differences to make informed investment decisions.

Software Solutions for Investment Management

In today's data-driven world of finance, the right software can be your most valuable asset. Explore cutting-edge solutions that empower you to optimize your investment management processes.

Top Alternative Funds to Diversify Your Portfolio

Diversification is the cornerstone of a resilient investment strategy. Explore our selection of top alternative funds that can help you diversify your portfolio and manage risk.

Free Hedge Fund Database: Your Comprehensive Resource

In the world of hedge fund investments, access to information is paramount. Explore our free hedge fund database – a valuable resource to empower your investment decisions.

Demystifying the Sharpe Ratio Equation

The Sharpe Ratio is a fundamental tool for assessing the risk-adjusted return of your investments. Dive into this essential metric, demystify its equation, and elevate your understanding of portfolio performance.

Hedge Fund vs. Mutual Funds: Which Is Right for You?

When it comes to evaluating hedge funds and alternative investments, the AIMA Due Diligence Questionnaire is an invaluable tool. Discover its significance and how it can shape your investment decisions.

Hedge Fund Consultancy

Are you considering hedge fund investments? Navigating the intricate landscape of alternative investments can be a challenging endeavor. That's where our Hedge Fund Consultancy services come in.

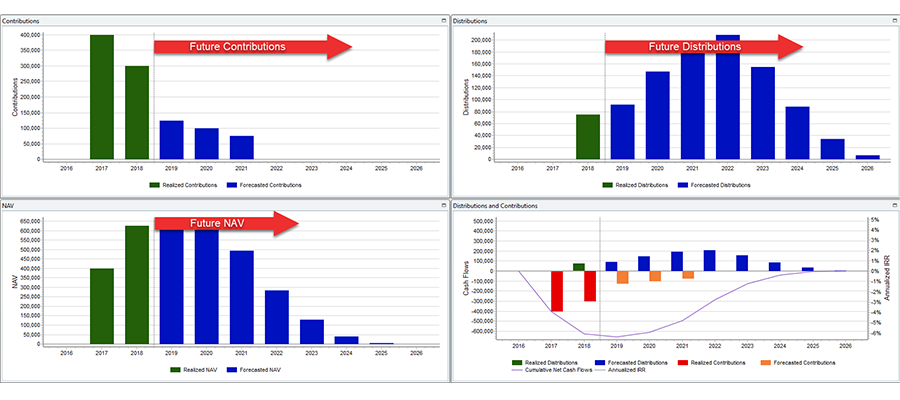

Private Equity Portfolio Management Software

In today's dynamic investment landscape, managing your private equity portfolio demands precision and efficiency. Discover the transformative power of Private Equity Portfolio Management Software at AlternativeSoft.

AIMA Due Diligence Questionnaire

When it comes to evaluating hedge funds and alternative investments, the AIMA Due Diligence Questionnaire is an invaluable tool. Discover its significance and how it can shape your investment decisions.

The importance of post-sales support when buying an investment management solution

Investment management solutions have changed the way investment managers manage their portfolios, but software tools like these aren’t always straightforward to implement and start using. This is where the value-add of post-sales support becomes crucial to successful solution adoption.

How to scale your portfolio analytics with AlternativeSoft

In fund Investing, the volume of data you need to access, manage and analyse can become overwhelming. And as your client base grows, managing portfolios becomes increasingly complex and prone to error. Discover how AlternativeSoft's scalable portfolio analytics solutions can help you to manage your data and processes at pace, efficiently and confidently.

How fund investors can take ownership of their Operational Due Diligence process

Post the 2008 financial crisis, regulatory requirements regarding operational efficiency have become more stringent, resulting in an increased focus from firms on their operational due diligence. Operational due diligence is the process by which investors evaluate how an investment firm is managed, and whether the firm’s personnel can be trusted to manage the firm for the benefit of its investors, not just its managers.

Streamline fund manager allocations by using an all-in-one due diligence solution

The challenges associated with effective manager allocation can be complex enough to allocators without onerous due diligence obligations. And with the ever-changing industry and regulatory ecosystem, conducting due diligence confidently is becoming increasingly difficult. This is where effective digital due diligence solutions can help.

How to future-proof Hedge Fund Risk Management

This article explores the challenges associated with managing risk and how fund investors and firms can benefit from comprehensive risk management solutions to effectively manage current and future risk, ensuring processes are as future-proofed as possible.

How cloud-based solutions bring efficiency and scalability to your Hedge Fund Due Diligence process

The adoption and use of cloud computing has become more and more prevalent in recent years, and providers of financial-technology solutions are increasingly offering cloud-hosted versions of their software to customers.

Transform your Operational Due Diligence process: Why Allocators use AlternativeSoft

Fund managers and allocators have become increasingly aware of operational risk and the need to transform their operational due diligence process to account for changing compliance expectations.

Related News

Hedge Funds Adjust Portfolios Amid Market Shifts

Recent 13F filings have unveiled significant shifts in hedge fund portfolios, reflecting broader market trends and economic developments. Notably, Tesla Inc. saw a 27% increase in hedge fund holdings, making it one of the most sought-after stocks among institutional investors. In contrast, Apple Inc. witnessed widespread divestitures totaling $1.5 billion, though Warren Buffett’s Berkshire Hathaway increased its stake by $5 billion, signaling long-term confidence in the company.

Top Hedge Fund Managers' Earnings in 2024

According to Bloomberg’s latest rankings, the top hedge fund managers of 2024 achieved record-breaking earnings, reaffirming the industry’s resilience despite market volatility.

The Rise of Private Credit: A Game Changer for Institutional Investors

In today’s evolving financial landscape, private credit has emerged as one of the fastest-growing asset classes, attracting significant interest from institutional investors. With traditional banks tightening lending standards and global interest rates fluctuating, private lenders are stepping in to fill the gap. According to recent reports, private credit assets under management (AUM) are projected to exceed $2 trillion by 2026, highlighting its increasing significance in diversified portfolios.

Interview with Don Steinbrugge Agecroft Partners

We interviewed Don Steinbrugge from Agecroft Partners and asked him some questions regarding the economy, coronavirus and conferences.

Only 4 Hedge Fund Sectors in the Black for April YTD

After a difficult few months due to the pandemic, Year-to-date, only 4 hedge fund sectors were in the black for April, including....

3 Decade Safe Bet Between US & Asian Stocks Falls Apart

S&P 500 index rose far above benchmark gauges in Asia.

Funds are Caught Between a Recovery Wave or a Further Market Crash

As the Covid-19 pandemic shows the earliest signs of drawing to a close, there are split opinions among hedge funds regarding what the next move should be.

Coronavirus is giving private equity firms what they were waiting for

PE firms sitting on $1.5tn to be used for “market dislocation”

How Coronavirus is impacting the hedge fund industry

Millions sent home as 3 hedge funds still manage to outperform market sell-off

Michael Platt made $2B without clients in 2019

Many believe Platt is the highest earning person in finance

Asgard Credit Fund with 29% returns is shorting Tesla Bonds

A Danish hedge fund by the name of Asgard Credit is shorting Tesla bonds

Voleon Group - Machine learning hedge fund sees 7% returns for 2019

Is machine learning beginning to take centre stage?

Ray Dalio’s Bridgewater is betting on gold to surge 30%

Greg Jensen Co-CIO believes these 3 reasons will cause gold to rise

Best rated Mutual Funds 2020

Conrad and Shilling’s top ten mutual funds list (With associated five-year returns)

More hedge funds have closed than those opened for 5th year in a row

Less than 9,000 hedge funds now exist globally

Singapore have the World’s best Hedge Fund returns

Singapore is home to two of the top ten HF in 2019

TCI Hedge Fund to Punish Directors Over Carbon Emissions

Airbus, Moody’s, Charter Communications and more have been warned by TCI

Has Private Equity reached its peak?

Fears grow as assets held by private equity firms grows 83% in past decade

Bridgewater $1.5B market fail bet is false according to Ray Dalio

Founder and Billionaire Ray Dalio takes to social media to contest WSJ

Here are the most Bought Stocks by Hedge Funds in Q3

Top 10 most loved stocks from 833 top hedge funds

Private equity partnership with NFL & MLB for players rights

Money being left on the table for player likeness, use of names and more

Tax status change sees shares soar in Private Equity firms

Switching from a partnership to a corporation has served many private equity firms very well.

Women hold just 8% of Senior Investment roles at Private Equity firms globally

For most firms’ women hold just 1 or 2 of the top positions on the buyout investment teams

$42bn side hustle for private equity as secondary deals soar

Secondary deals have already broken 42bn for the first semester of 2019

The ECB cuts rates whilst restarting bond-buying

The European Central Bank has lowered its deposit rate by 10 basis points as Draghi looks to step down next month

Jonathan Sorrell to step down as president of Man Group

Sorrell to take up a senior role at rival asset management firm

US private equity firm KKR & Co, buys majority stake in Indian ECEC provider

$400m for majority stake in one of India’s largest education service providers EuroKids

Private equity duo in $16bn buyout proposal with Symantec

Two private equity companies are looking to co-own the makers of Norton Anti-Virus software

A top hedge fund of 2019 goes big on gold

180% stake increase makes gold hedge funds biggest held position

Hedge funds made hundreds of millions from heat waves across Europe

Soaring temperatures leads to 60% increase in carbon-emissions credits

Muddy Waters’ Carson Block swinging short-selling scythe at London’s Burford Capital

Some firms have raised billions to take general partner stakes in other private equity players.

Multi-asset funds out-perform fund of funds

Berlin based ratings company “Scope” found that Multi-asset funds that invest directly in securities outperformed fund-of-funds over a 10-year period.

Losing 1.8bn in a single day wasn’t enough for Hasenstab, now has biggest bet against treasuries of any major global bond fund

Franklin Templeton and Hasenstab dividing global opinion with latest bet

Private equity firms betting on each other

Some firms have raised billions to take general partner stakes in other private equity players.

Buying Uber – Selling Microsoft. The biggest bets from hedge funds in past 3 months

Top 5 buys and sells from the world’s biggest hedge funds

Hedge funds thriving despite slowing global economy and renewed trade tensions

Traders have dumped riskier assets such as stocks and crude oil moving towards “safe havens assets” including bonds.

Hedge funds hits back at pro-brexit Channel 4 claims

Reports of hedge funds pushing for brexit have been rubbished by multiple sources.

World’s largest pension fund is promoting an ESG future

GPIF want to make the market more sustainable not beat it.

Hedge funds turning to Gold amidst recession fears

Gold has risen 18% this year making it a refuge for hedge funds.

Authentic Brands Group now valued at $4.5b after BlackRock LTPC first deal

ABG is critical first deal for BlackRock as they continue to fundraise with target of $12b for LTPC fund.

Will Private Equity return to the Middle-East?

After the antics of Abraaj Group investors have been reluctant to seek other opportunities in this region of the world.

Studies find; Hedge Fund Managers with “skin in the game” outperform

Funds which rely more on insider money outperform funds that use asset gathering.

Disney plotting Netflix demise with $12.99 per month streaming bundle

Disney Plus, Hulu and ESPN for the same price as Netflix suggests direct attack.

Why has it been harder for hedge fund start-ups to raise money in 2019?

Only one new hedge fund has managed to reach $2b this year, $6b shy of last year’s highest total.

£94m of Aston Martin shares are being shorted

Investors are gambling on further falls in share price.

Private equity group Carlyle will abandon partnership status in January

Carlyle look to improve share price with inclusion in index tracker funds.

Boris Johnson is giving hedge funds and traders a free-hit

Sterling falls to 2 and half year low as no-deal Brexit becomes real possibility.

ESG Investing will be Key in the next 5 years according to 65% of Hedge Fund Investors

Society is on the precipice of major shifts in wealth, energy sources and morality, could ESG investing turn the heads of hedge fund managers?

Equinox Energy Fund to close

President releases brutally honest evaluation of what went wrong

85% loss of partners money after energy stocks have a tough year. Energy fund Equinox Energy has announced its plans to close their fund after 4 and a half years of torment losing 85% of their partners money.

Software Updates

AlternativeSoft Partners with Nasdaq eVestment™ to Enhance Institutional Investment Data Access and Portfolio Analytics

This partnership brings together AlternativeSoft’s powerful analytics platform and Nasdaq eVestment’s Hedge Fund Database and Traditional Long Only Manager Data, enabling mutual institutional investors to make data-driven decisions deploy their resources more productively and ultimately realize better outcomes.

AlternativeSoft Partners with Albourne to Enhance Hedge Fund Analytics with Cutting-Edge Risk Premia Indices

We’re thrilled to announce that AlternativeSoft has partnered with Albourne to integrate their comprehensive Alternative Risk Premia Indices: AltERS, into our award-winning analytics platform.

AI-Powered Due Diligence Questionnaire

Completing due diligence questionnaires can be a tedious task. We’re thrilled to announce an upcoming AI feature that will automatically complete standard due diligence questionnaires submitted by hedge funds.

Style Analysis - Utilize Our New Style Analysis Technique in Finding Funds That Deliver Alpha

Collaborative investments in private equity can be complicated. We’re here to simplify the process! Our new Private Equity Series feature illustrates a straightforward solution for managing scenarios where multiple investors come together to invest in a private equity fund.

Private Markets - Discover the Power of Our Private Equity Module with ILPA Import Support

Unlocking actionable insights on alpha generation is crucial for any investor. We’re excited to introduce our latest feature that empowers you to effortlessly convert selected assets into Alpha time series.

Advanced Search Bar

Managing private equity assets can sometimes feel like a balancing act. We understand the challenges, which is why we’ve introduced a new feature to help you convert private equity data into more frequent time series using public market indices.

Data Universe: Ability to Convert Private Assets into PME

Managing private equity assets can sometimes feel like a balancing act. We understand the challenges, which is why we’ve introduced a new feature to help you convert private equity data into more frequent time series using public market indices.

Convert Asset into Alpha

Unlocking actionable insights on alpha generation is crucial for any investor. We’re excited to introduce our latest feature that empowers you to effortlessly convert selected assets into Alpha time series.

![Hedge Fund Fact Sheet on the Cloud [FREE]](img/blog/updated/private-equity-series-with-new-commitments.png)

Private Equity Series with New Commitments

Collaborative investments in private equity can be complicated. We’re here to simplify the process! Our new Private Equity Series feature illustrates a straightforward solution for managing scenarios where multiple investors come together to invest in a private equity fund.

AI Integration [FREE]

Harnessing the power of AI can revolutionize your approach to hedge funds and mutual funds. We’re excited to introduce our desktop tool that provides AI-generated ratings for fund performance—entirely free of charge!

Collect Returns from your Hedge Funds [FREE]

Streamlining your data collection process can save you time and effort. We’re pleased to introduce a new feature that allows you to invite your hedge funds to upload returns, documents, and questionnaires to a secure, private webpage.

![Hedge Fund Fact Sheet on the Cloud [FREE]](img/blog/updated/hedge-fund-fact-sheet-on-the-cloud.png)

Hedge Fund Fact Sheet on the Cloud [FREE]

Making informed decisions about hedge fund investments is vital for your success. That’s why we’re excited to offer instant access to comprehensive Hedge Fund fact sheets directly from the cloud—exclusively for our HFR subscribers.

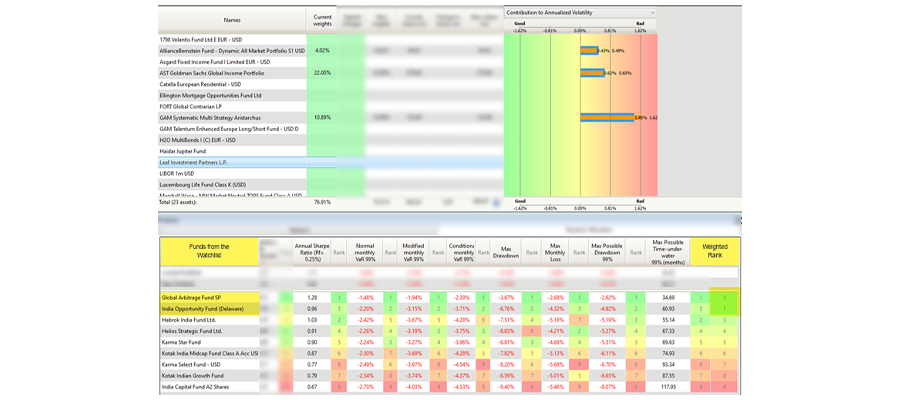

Portfolio Management Reports

Understanding your portfolio structure is key to making informed investment decisions. We’re pleased to announce new reports designed to provide you with deeper insights into your portfolio.

Sharable Due Diligence Reports Across AlternativeSoft

Collaboration among hedge fund allocators is essential for informed decision-making. We’re excited to introduce a new feature that allows allocators to securely share their due diligence reports on hedge funds within the AlternativeSoft cloud platform, maintaining full anonymity.

AI-Powered Due Diligence Questionnaire

Completing due diligence questionnaires can be a tedious task. We’re thrilled to announce an upcoming AI feature that will automatically complete standard due diligence questionnaires submitted by hedge funds.

SOC 2 Certified for Your Peace of Mind

At AlternativeSoft, we are dedicated to safeguarding your data and ensuring the highest levels of security and compliance. We are proud to announce that we have achieved SOC 2 (System and Organization Controls 2) certification, a significant milestone that underscores our commitment to your data's safety.

Combine hedge funds trading and private equity funds trading in our portfolio management platform

Our clients are now able to manage a hedge funds and private equity funds’ portfolio using contributions and distributions.

New testimonials from our trusted clients

Find out why some of the world’s largest pension funds, fund of funds, family offices, private banks, endowments, foundations, wealth managers and advisers trust AlternativeSoft to identify and analyse multi-asset class portfolios of hedge funds, mutual funds, ETFs and private market funds.

AlternativeSoft clients are not affected by source code Log4j

Recently, a critical vulnerability in source code Log4j has impacted some companies worldwide. We want to ensure all our clients that our products and solutions do not use Java or Log4j library. All client data remains safe and secure.

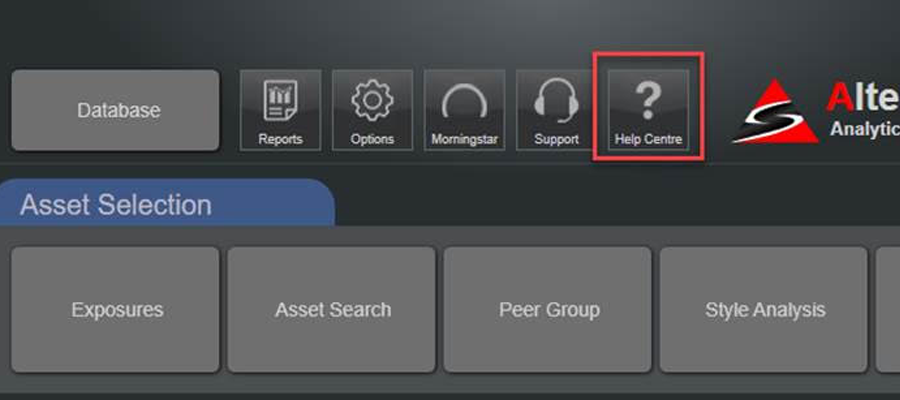

New "Help Centre" button on the landing page of AlternativeSoft

This new feature helps our clients easily explore the User Manual, access the Video training guides as well as look through the FAQs. In addition, it also allows our clients to book 1 on 1 meetings though the Webinar Training.

Export: added ability to produce PowerPoint batch report

This features allows you to create batch reports, in Powerpoint format, using the Active worksheet as a template. As a result clients can now export their custom reports to Powerpoint quickly and easily.

Due Diligence Exchange (DD-x) From AlternativeSoft

Due diligence can be exceptionally time-consuming, when you have to deal with the collection of returns, estimates, weights, documents and questionnaires.

Discover The Best Funds To Add To Your Portfolio.

Using the new feature, clients can select up to 10 funds and control which specific funds improve performance in terms of portfolio statistics such as return, volatility, drawdown, maximum monthly loss or VaR.

Offering of NilssonHedge Fund data as a free data set for our clients

We are proud announce that it now supports NilssonHedge Fund data as a free data set for our clients on our desktop and cloud based solution.

The Application Designed by you... Built by us!

We are proud to introduce our new cloud based application AlternativeSoft Due Diligence Exchange.

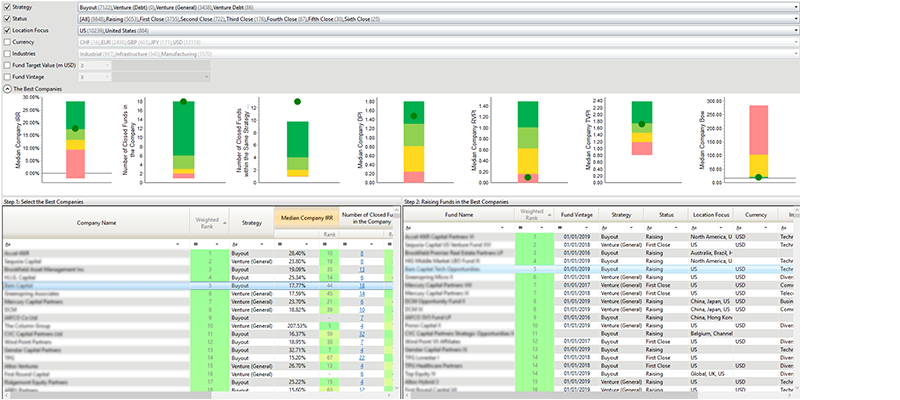

New Features in the Private Equity Module

AlternativeSoft are proud to announce our latest new features for our Private Equity module.

Best Performing Funds in Peer Group

Type a Fund Name among our aggregated database of over 150,000 funds and visualize that funds extreme risks and see which other funds have consistently better returns within the same strategy.

Yale Model Implemented in Private Equity Module

AlternativeSoft has implemented the Yale model in the Private Equity Module of AlternativeSoft. This allows Private Equity investors to easily define the return they expect from their investment in a Private Equity fund.

Company Updates

AlternativeSoft has been honoured with the prestigious Hedgeweek Best Risk Management Software Award for the fifth consecutive year in 2023

This remarkable achievement wouldn't have been possible without the unwavering support and trust of our valued clients. Your confidence in us is our biggest motivation, and we are incredibly grateful for your ongoing support.

Witherspoon Selects AlternativeSoft's Portfolio Analytics to Power Analytics and Reporting

AlternativeSoft, a global provider of asset selection, operational due diligence, and portfolio construction solutions, has announced that Witherspoon, an asset manager who specializes in liquid alternative investments, has integrated AlternativeSoft’s Portfolio Construction module into its asset management platform, creating a powerful decision-making platform for alternatives

Take your portfolio construction to the next level

A good investment is one thing, but combining ideas and strategies for maximum return means constructing optimal portfolios. Portfolio construction can help you extract the maximum potential out of your investments, but if your portfolio construction process isn’t complemented with a flexible digital solution, you’ll end up spending more time, money and effort in the long run.

AlternativeSoft Wins Award for Best Risk Management Software 2022

AlternativeSoft won the award for ‘Best Risk Management Software’ in the Hedgeweek European Awards for the forth time, marking our 9th award in 10 years, winning the award in back to back concessions!

What to consider when choosing the right solution for your firm

Product selection, asset allocation, data leveraging and effective portfolio building are all constructive approaches to ensuring success against market volatility and evolving regulatory requirements. But risk, and effectively managing risk, has become of paramount importance in optimal fund management, with firms and fund managers honing in on the best practices and approaches to secure portfolios against the impacts of risk.

Leading Portfolio Construction Solution Provider Brings on Round of New Hires to Fuel Company’s Growth

AlternativeSoft are excited to announce the appointment of Ayman Abouhend as Company Officer for Mergers and Growth, Christopher Demetropoulos, who joins in an advisory role as a board member and Steve Gollins as Head of Sales in North America.

AlternativeSoft Wins Award for Best Risk Management Software 2021

AlternativeSoft won the award for ‘Best Risk Management Software’ in the Hedgeweek European Awards.

Coronavirus Update

In light of the Coronavirus pandemic, we have decided to implement a work from home policy which has been robustly tested over the last few weeks.

We Have Moved Offices

We are excited to announce that our team has moved to a new location in Farringdon. 81 Farringdon Street, London, EC4A 4BL

AlternativeSoft Expands Client Base in Asia and the US

Over the summer AlternativeSoft have been busy onboarded several large financial institutions.

AlternativeSoft Strengthens Data Partnership with Morningstar

AlternativeSoft users will gain free access to over 100 free global equity indices thanks to Morningstar’s Open Indexes Project.

JOIN US FOR OUR INAUGURAL WEBINAR

Join AlternativeSoft in the first of our series of webinars on the best-performing hedge funds and mutual funds and tips for selecting funds that perform across all market conditions.

AlternativeSoft Wraps up a Fantastic 2016

YTD year on year sales increase of 30% and expansion of our Sales, Support and Quantitative Teams which now takes our total head count to 35 as well as a new office.

AlternativeSoft Hires and Continues Expansion of it London Office

AlternativeSoft hired and continues the expansion of its London office by boosting our existing Client Services team with 3 new faces!

Events

Markets Group ALTSCHI Conference, Chicago

Interested in how AlternativeSoft can help Fund Managers and Allocators thrive in the current market? As sponsors of the Markets Group ALTSCHI in Chicago, we’d be happy to discuss—be sure to schedule a meeting with us!

Markets Group ALTSME conference in Riyadh, Saudi Arabia

Curious to learn more about what AlternativeSoft can offer Fund Managers and Allocators in this dynamic landscape? Don't miss the chance to schedule a meeting with us at ALTSME Riyadh.

HED Singapore 2024

If you’re attending HED Singapore, don’t miss the chance to connect with us and explore innovative possibilities. Let’s make valuable connections and drive the future of finance together!

Markets Group ALTSSG conference in Singapore

Curious to learn more about what AlternativeSoft can offer Fund Managers and Allocators in this dynamic landscape? Don't miss the chance to schedule a meeting with us at ALTSSG Singapore.

Patrimonia Convention, Lyon, France

Curious to learn more about what AlternativeSoft can offer Fund Managers and Allocators in today's dynamic landscape? We proudly sponsored the Patrimonia Convention in Lyon—don’t miss the chance to schedule a meeting with us!

Markets Group ALTSCHI Conference, Chicago

Interested in how AlternativeSoft can help Fund Managers and Allocators thrive in the current market? As sponsors of the Markets Group ALTSCHI in Chicago, we’d be happy to discuss—be sure to schedule a meeting with us!

Markets Group ALTSLA Conference, Los Angeles

Want to discover how AlternativeSoft supports Fund Managers and Allocators in navigating today’s dynamic landscape? As a proud sponsor of the Markets Group ALTSLA in Los Angeles, we'd love to connect—schedule a meeting with us!

Markets Group ALTSME conference in Dubai

Curious to learn more about what AlternativeSoft can offer Fund Managers and Allocators in this dynamic landscape? Don't miss the chance to schedule a meeting with us at ALTSME Dubai.

SIPUGday Zurich 2023

If you’re attending SIPUGday, don’t miss the chance to connect with us and explore innovative possibilities. Let’s make valuable connections and drive the future of finance together!

IPEM Paris 2023

AlternativeSoft is delighted to be attending the latest IPEM Paris 2023, on the 18th - 20th September 2023 at the Westin Vendôme and the Jardin des Tuileries, Paris.

AIM Summit London Edition conference

AlternativeSoft is delighted to be attending the latest AIM Summit London Edition, on the 13th - 14th April 2023 at the Four Seasons Hotel London, Ten Trinity Square.

Markets Group ALTS Series conference in Los Angeles

AlternativeSoft is delighted to be sponsoring the latest Markets Group ALTSLA conference, on the 27th - 29th March 2023, in Los Angeles.

Markets Group Annual Private Wealth Forum in Zurich

AlternativeSoft is delighted to be attending the latest Private Wealth Switzerland Forum Zurich, on the 14th December 2022, in Zurich, Switzerland.

AlternativeSoft Sponsors AIM Summit, Dubai Edition.

To learn more about how AlternativeSoft's award-winning solutions are helping some of the world's largest investors make smarter investment decisions, stop by and meet Ben and James.

AlternativeSoft Sponsors Talking Hedge Toronto, Canada.

To learn more about how AlternativeSoft's award-winning solutions are helping some of the world's largest investors make smarter investment decisions, stop by and meet Steve and Ravi.

AlternativeSoft Sponsors Talking Hedge conference, Austin Texas.

To learn more about how AlternativeSoft's award-winning solutions are helping some of the world's largest investors make smarter investment decisions, stop by and meet Steve and Dipesh.

AlternativeSoft Sponsors Context Summits Miami

To find out how AlternativeSoft's industry leading solutions are helping some of the world's largest Hedge Fund Allocators make better informed investment decisions stop by our booth and meet our team. For more information please contact us.

AlternativeSoft Sponsors the 2020 Emerging Manager Conference

To learn more about how AlternativeSoft's award-winning solutions are helping some of the world's largest investors make smarter investment decisions, stop by and meet Alex and Scott.

AlternativeSoft Sponsors Context Summits Miami 2020

To learn more about how AlternativeSoft's award-winning solutions are helping some of the world's largest investors make smarter investment decisions, stop by and meet Alex and Scott.

AlternativeSoft Sponsors Context Summit New York

To learn more about how AlternativeSoft's award-winning solutions are helping some of the world's largest investors make smarter investment decisions, stop by booth 102 and meet Alex and Scott.

AlternativeSoft Sponsors Eurekahedge Asian Hedge Fund Awards 2019

AlternativeSoft is proud to be sponsoring the Best Singapore-Based Hedge Fund Award at the Eurekahedge Asian Hedge Fund Awards 2019 later this week.

Good luck to all of the nominees!

AlternativeSoft Sponsors Context Summits Europe

To learn more about how AlternativeSoft's award-winning solutions are helping some of the world's largest investors make smarter investment decisions, stop by booth 31 and meet Dominique, Alex and James.

AlternativeSoft Sponsors Context Summits Miami

To find out how AlternativeSoft's industry leading solutions are helping some of the world's largest Hedge Fund Allocators make better informed investment decisions stop by our booth and meet our team. For more information please contact us.

Awards

AlternativeSoft Wins Award for Best Risk Management Software 2023

This remarkable achievement wouldn't have been possible without the unwavering support and trust of our valued clients. Your confidence in us is our biggest motivation, and we are incredibly grateful for your ongoing support.

AlternativeSoft Wins Award for Best Risk Management Software 2022

AlternativeSoft won the award for ‘Best Risk Management Software’ in the Hedgeweek European Awards.

AlternativeSoft Wins Award for Best Risk Management Software 2021

AlternativeSoft won the award for ‘Best Risk Management Software’ in the Hedgeweek European Awards.

AlternativeSoft Wins Award for Best Risk Management Software 2020

AlternativeSoft won the award for ‘Best Risk Management Software’ in the Hedgeweek Global Awards.

AlternativeSoft Wins Award for Best Risk Management Software 2019

AlternativeSoft won the award for ‘Best Risk Management Software’ in the Hedgeweek Global Awards.

AlternativeSoft Wins Award for Best Risk Management Software 2017

AlternativeSoft won the award for ‘Best Risk Management Software’ in the Hedgeweek USA Awards.

First place in the ‘Technology Provider for Risk Management’ category 2015

First place in the ‘Technology Provider for Risk Management’ category of Hedge Funds Review Service Provider Rankings.

First place in the ‘Technology Provider for Risk Management’ category 2014

First place in the ‘Technology Provider for Risk Management’ category of Hedge Funds Review Service Provider Rankings.

First place in the ‘Technology Provider for Risk Management’ category 2013

First place in the ‘Technology Provider for Risk Management’ category of Hedge Funds Review Service Provider Rankings.

Office Location

UK: 10 Lower Thames Street, London

EC3R 6AF

USA: 200 South Wacker Drive, 31st Floor,

Office 3214, Chicago, IL 60606