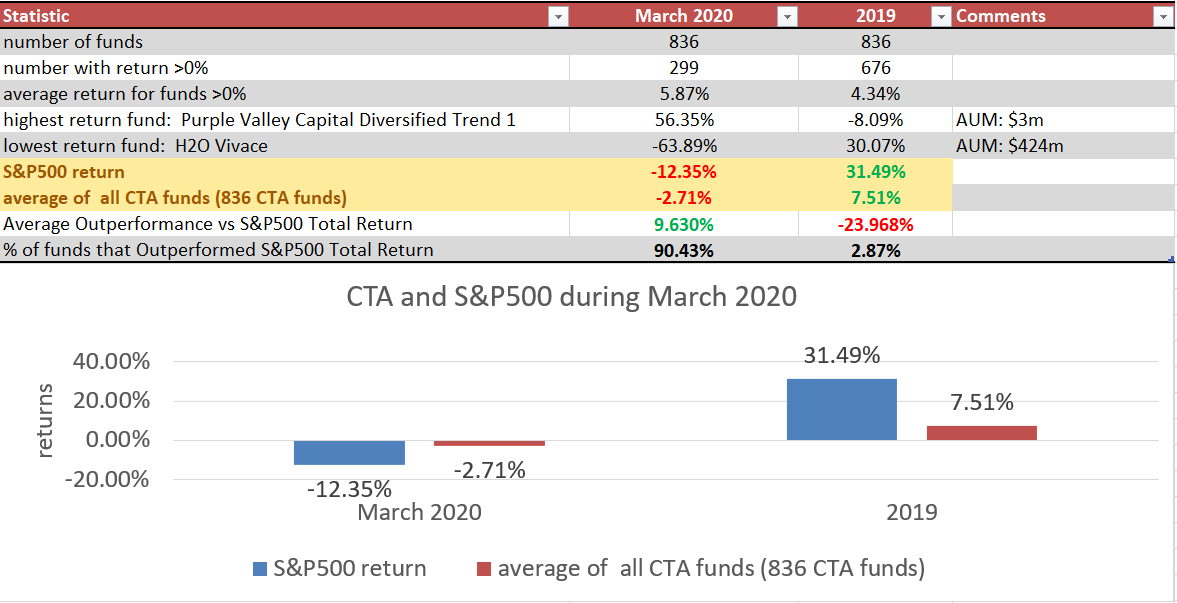

This analysis uses 836 CTA (Commodity Trading Advisor) Hedge Funds and compares their returns in March 2020 and for the year 2019. Data for these funds are provided by NilssonHedge, EurekaHedge and HFR.

On the other hand, when we look at the performance of these funds in a normal year like 2019 without significant bearish pressures, the results are not as impressive:

In the long-term, CTA hedge funds do not seem to be a solution that is able to generate higher returns than the S&P500. However, their ability to mitigate bearish pressures must not be underestimated and shows potential to be of great use for diversification purposes.

AlternativeSoft is an award-winning quantitative analytics software specialising in asset selection, portfolio construction and customised reporting. To find out more or register for a free demo, get in touch with our team.

71 Carter Lane, London,

EC4V 5EQ

+44 20 7510 2003