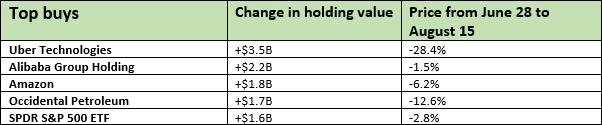

After its public offering in May, ride-hauling company Uber has been a clear favourite with the world’s largest hedge funds.

Biggest bet for Uber came from Julian Robertson’s Tiger Management with a very assured wager of $1.4 billion.

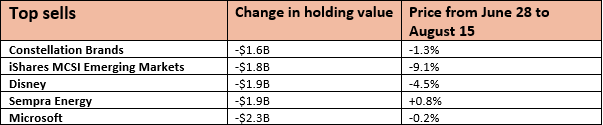

In contrast the least favoured stock was that of Microsoft, which may change as they strengthen their partnership with Samsung.

Constellation brands have been impacted by the Trump administration as they sell beer and tequila from Mexico to the U.S. Hedge funds decided to flee as immigration and trade threats were made by Mexico’s neighbour.

iShares MCSI Emerging Markets has suffered from the China- U.S trade war with traders yanking $1.4B from the stock in July.

Elliot exited its $1.4B position in Sempra Energy after reaching an agreement in October to add two new directors to the utility’s board.

Uber have suffered from losses and stock price drop since their IPO, which may be encouraging traders to buy at a lower price.

To find out more or register for a free demo, get in touch with our team.

71 Carter Lane, London,

EC4V 5EQ

+44 20 7510 2003