COVID 19 has had an impact across economies and required a robust government response. In March 2020 the U.S. equity market S&P 500 lost -34% in 33 days and quantitative easing has been widespread. Many economies have seen a fall in GDP and a rise in unemployment as a result of the conditions that have been created by the pandemic. However, equity markets went up – and continue to do so. Given that so much seems unpredictable right now where should the intelligent investor invest?

One of the major responses to the impact of COVID 19 across the world has been the introduction of stimulus packages by governments. Central banks have a number of tools that can be used to tackle the kind of debt burdens that this creates, including inflation and financial repression. However, these methods are not fool proof – inflation can take a long time to impact debt while financial repression needs to be a lot harder and more impactful than most societies are used to, or will tolerate right now. That’s why debt restructuring stands out as the most obvious choice. Debt restructuring can have a number of consequences including a banking crisis or the devaluation of the wealth of individuals and businesses. However, given that governments are currently printing money, buying mortgages, government, corporate and high yield debts and paying furlough these are the least likely outcomes. Instead, we could see a currency crisis as foreign investors are willing to avoid the devaluating currencies and countries may well take steps to devalue their currencies at the same time.

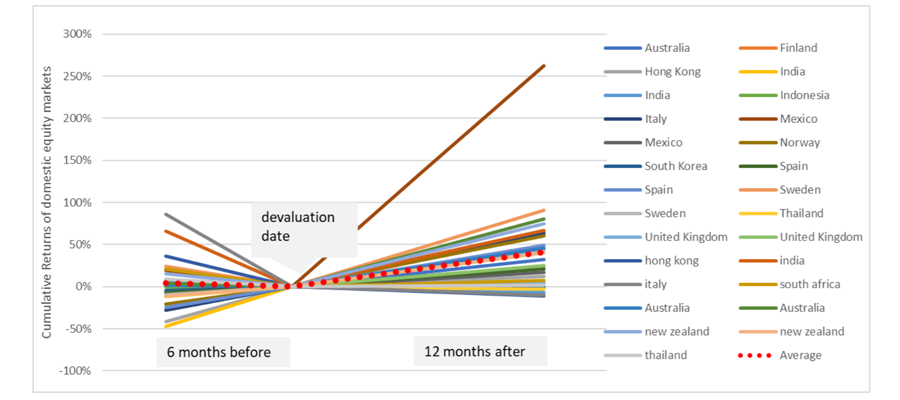

History shows us that before currencies are devalued, the stock market tends to shoot up and that this upward trend continues even once devaluation has taken place. Equities do particularly well during a devaluation but less so after, while gold does well throughout. So, how can this data be compiled into an investment strategy that will enable a positive outcome under the current circumstances?

Source: globalfinancialdata.com

Download the complete paper here

To find out how AlternativeSoft can help your fund selection and due diligence process register for a free demo of our software.

71 Carter Lane, London,

EC4V 5EQ

+44 20 7510 2003