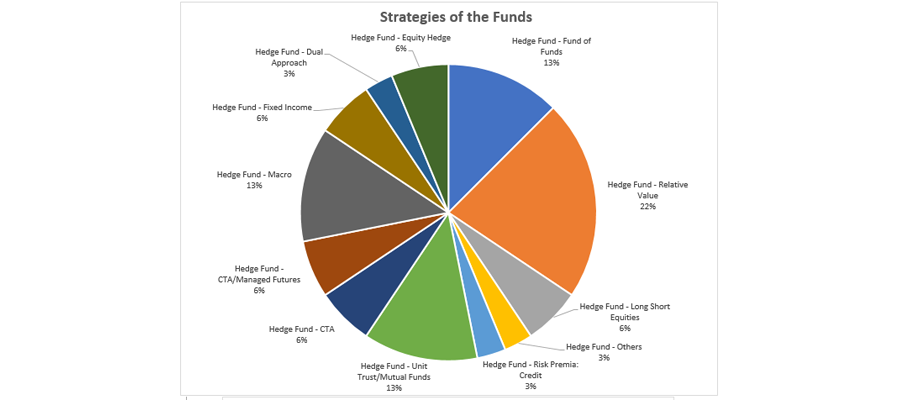

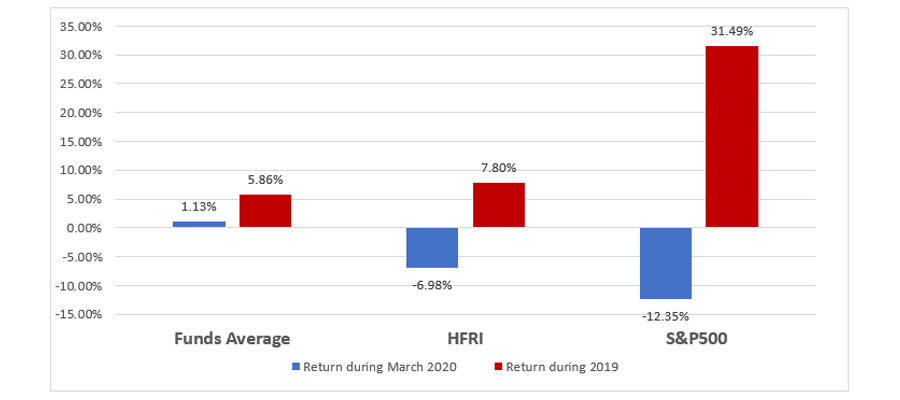

We selected 32 hedge funds with an Annual Sharpe Ratio greater than 4 during the period Jan2010-Feb2020and with at least $10M of assets under management. We compared their returns in March 2020 against the S&P500 TR Index. The data was kindly provided by Hedge Fund Research and EurekaHedge.

Our sample of 32 hedge funds had an Average Annual Sharpe Ratio of 11.10 during Jan10-Feb20.

To summarize, the 32 hedge funds with the highest Annual Sharpe ratio outpeformed by far the HFRI index in March 2020. Will it be still the case in May 2020? Follow us to know the answer.

AlternativeSoft is an award-winning quantitative analytics software specialising in asset selection, portfolio construction and customised reporting. To find out more sbout how the above informtion was extracted from our software or register for a free demo, get in touch with us today.

71 Carter Lane, London,

EC4V 5EQ

+44 20 7510 2003