Market-neutral funds are actively managed to be independent from both upward and downward market movemements. Usually, this is achieved through the use of paired long and short positions. These funds can potentially serve to mitigate market risk as they seek to generate positive returns in all market environments.

We investigated whether market-neutral funds could ‘neutralize’ the effect of stock market movements during crisis periods and thus, be a good addition to a portfolio.

To demonstrate, we selected 90 market-neutral hedge funds - denominated in USD - and checked their Beta to S&P 500 during two equal time periods. The first period was before the COVID-19 crisis, the second started with the COVID-19 crisis. Both periods lasted 18 months.

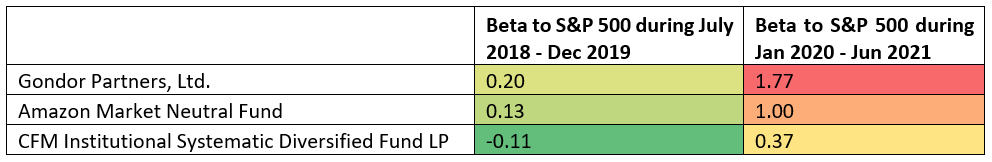

Table 1 - Top 3 funds with largest increase in beta starting with the COVID-19 crisis

Source: HFR, HFM, Eurekahedge.

Table 1 shows that not all of the market-neutral funds managed to keep their beta around July 2018 – December 2019 and some had a huge increase in Beta in the period January 2020 – June 2021.

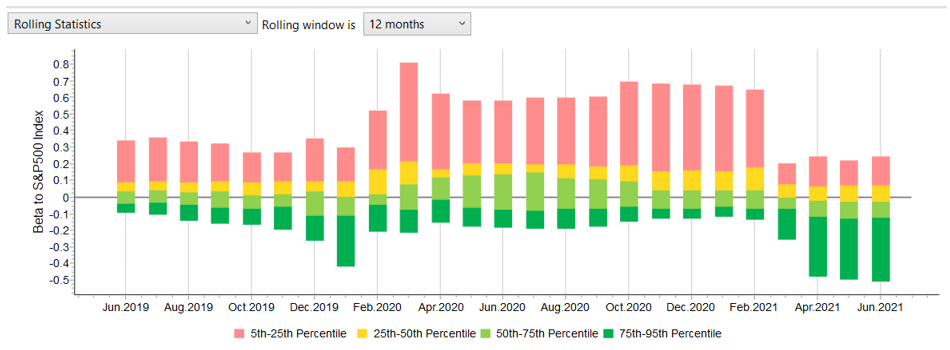

Source: HFR, HFM, Eurekahedge, AlternativeSoft.

If we look at the Rolling Beta to S&P 500 bar chart for the market-neutral hedge funds peer group we see betas of some funds in the 5th-25th percentile increased during the crisis. Even though, in general, as market sensitivity increases; betas remain in a reasonable range for more than 75% of the market-neutral funds.

In conclusion, while market-neutral hedge fund performance is considered to be unrelated to upward and downward market movement, hedge fund investors should consider that, during times of crisis, markets tend to move together and therefore it is harder to provide market-neutral returns. It is recommended to perform in depth due diligence, quantitative analysis, and your own market views when adding market-neutral hedge funds to your portfolio.

N.B. This article does not constitute any professional investment advice or recommendations to buy, sell, or hold any investments or investment products of any kind, and should be treated as more of an illustrative piece for educational purposes.

To trial a truly powerful and comprehensive analytic software for investment decisions, fund allocation, and our new, innovative digital due diligence visit alternativesoft.com , call us on +44 20 7510 2003, or email us information@alternativesoft.com

71 Carter Lane, London

EC4V 5EQ

+44 20 7510 2003