Evergrande Group (Guangzhou, China) has seen an 84% reduction in share price year-to-date. Concerns over the company’s ability to meet its debt obligations have sparked fears of a global financial crisis. Investors and stakeholders are watching the Evergrande saga develop with many speculating that the Chinese Communist Party (CCP) will bail out the real estate behemoth.

Chinese real estate is a keystone industry with some of China’s biggest listed firms being involved in real estate development. However, companies such as Evergrande Group (3333.HK), Country Garden (2007.HK), and China Vanke (2202.HK) are all highly leveraged with roughly $300bn, $250bn, and $230bn in liabilities1 respectively.

The topic is contentious in China, it is worth noting that many people have paid Evergrande for properties that have yet to be delivered or built and that, for many Chinese nationals, their real estate investment represents their life savings.

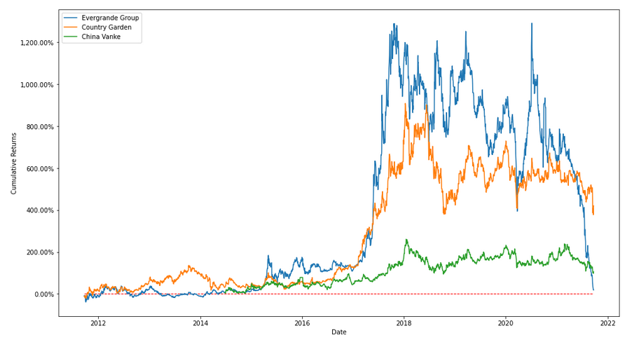

Investors are panicked, Figure 1 shows the 10-year cumulative returns (7 years China Vanke) for the aforementioned equities. It shows the startling -84% drop for Evergrande Group shares over the past year, it also seems to show some negative sentiment for the other two real estate giants.

Figure 1: 10-year Cumulative Returns (3333.HK, 2007.HK, 2202.HK).

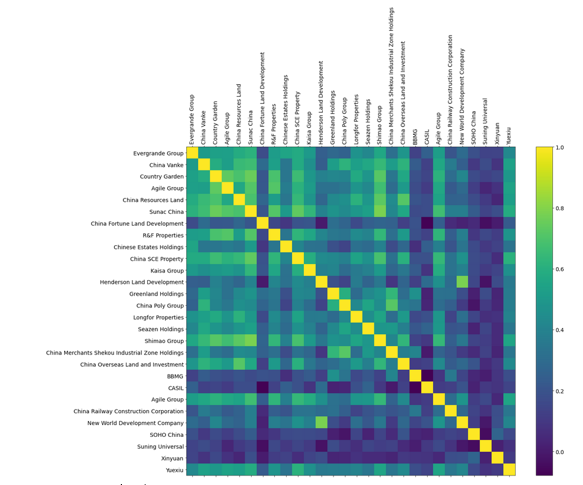

What does the Evergrande fiasco mean for Chinese real estate stocks? It’s hard to tell if the CCP will impose sweeping regulations that will have a harsh impact on these firms and property prices in China. We can assume there will be some legislative intervention based on the CCP’s views on real estate. The 1-year correlations of a cross-section within the Chinese real estate industry are surprisingly low, as seen in figure 2. It seems without systemic changes, or wider financial collapse, other Chinese real estate firms are insulated from what has been going on with Evergrande.

Figure 2: Correlation Matrix (2021) for Chinese real estate equities - daily.

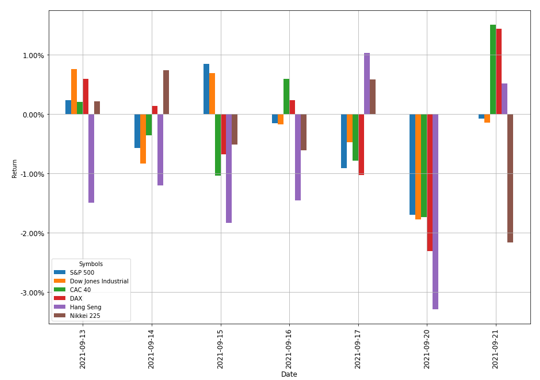

Figure 3: Global Index Returns.

How has this impacted financial markets across the globe? Figure 3 shows the daily returns since the 13th of September for a selection of global indices. The date of interest is Monday 20th of September which shows a global pull-back with the Hang Seng Index dropping 3.29%. Interestingly, the 21st shows some recovery across the board; Nikkei shows lagged effects of the Monday movement.

As we wait for the resolution, markets seem to be easing their fears over Evergrande (22/09/2021). It is being reported that the Chinese government will bail out Evergrande, but this will not include foreign debt. Evergrande has lost 32.64% in the last 7 days and 10.63% since Friday. Whatever happens, investors are eagerly awaiting the reopening of exchanges to see the impact of this growing story.

In the next related piece, we will take a closer look at how AlternativeSoft allows investors to ascertain fund exposure levels and decompose portfolio risk and return to help mitigate the impact of such events on institutional portfolios.

Resources:

1 WSJ Market Data, accessed 22/09/2021, available at .www.wsj.com/market-data

N.B. This article does not constitute any professional investment advice or recommendations to buy, sell, or hold any investments or investment products of any kind, and should be treated as more of an illustrative piece for educational purposes.

To trial a truly powerful and comprehensive analytic software for investment decisions, fund allocation, and our new, innovative digital due diligence visit alternativesoft.com , call us on +44 20 7510 2003, or email us information@alternativesoft.com

71 Carter Lane, London

EC4V 5EQ

+44 20 7510 2003