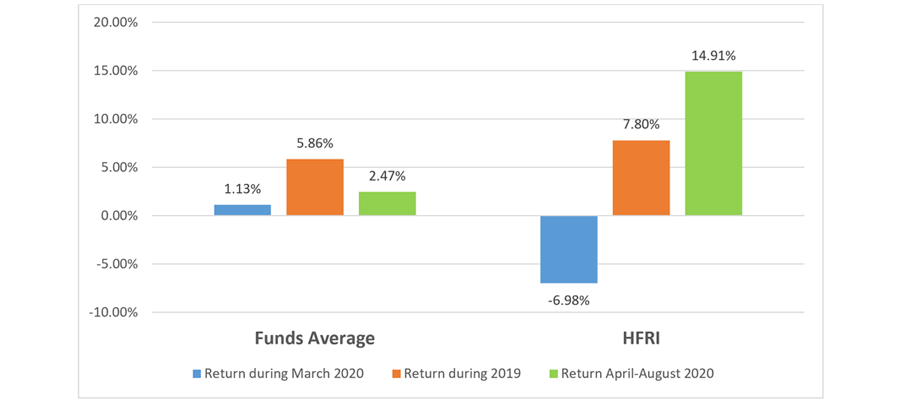

We found that the 32 hedge funds with an annual Sharpe ratio > 4 during the period Jan2010-Feb2020, performed well in Mar2020 and badly during Apr2020-Aug2020 vs the HFRI WC hedge fund index.

In our first article, published in May 2020, we selected 32 hedge funds with an Annual Sharpe Ratio > 4, during the period Jan2010-Feb2020 and with at least $10m of assets under management. We compared the average return of these 32 hedge funds and with the S&P500 TR and HFRI WC indices. We found that these 32 hedge funds outperformed the two indices (+13.48% and +8.11% respectively) during March 2020.

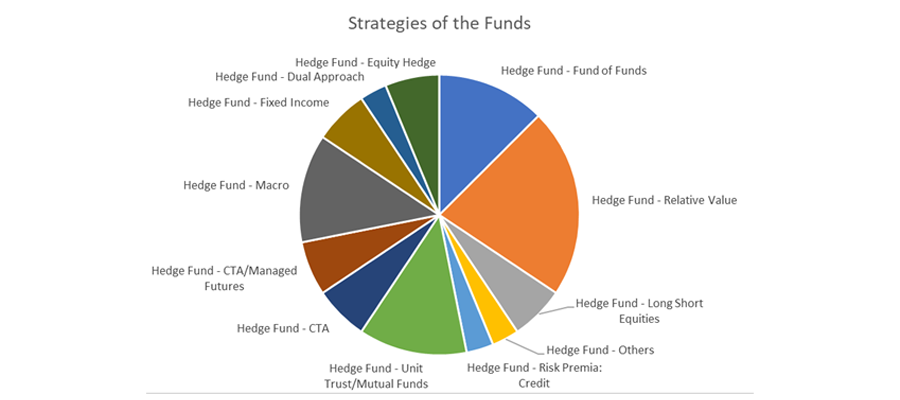

The pie chart below shows the breakdown of the strategies of the 32 selected hedge funds to highlight that there no strategies bias in the 32 hedge funds with annual Sharpe ratio > 4.

In this second article, we updated the article by adding April 2020 to August 2020 returns.

We found the following: during Apr2020-Aug2020, the 32 hedge funds, with an annual Sharpe Ratio > 4 between 2010 and 2020, generated only 2.47% cumulative returns, whereas the HFRI WC index generated 12.71%, i.e. a -10.24% underperformance of our 32 hedge funds during the covid19 recovery.

To conclude, if on one hand these hedge funds with high annual Sharpe ratio were positive during the financial shock caused by COVID-19 in March 2020, on the other hand these hedge funds have underperformed their peers during the recovery that took place during Apr20-Aug2020. This result could be due to two reasons:

Advisors and analysts looking for a truly powerful analytic solution for investment decision-making should visit www.alternativesoft.com for a trial, or telephone +44 20 7510 2003. Alternatively, email information@alternativesoft.com

AlternativeSoft is an award-winning quantitative analytics software specialising in asset selection, portfolio construction and customised reporting. To find out more sbout how the above informtion was extracted from our software or register for a free demo, get in touch with us today.

71 Carter Lane, London,

EC4V 5EQ

+44 20 7510 2003