Leveraging Data Aggregation for Superior Mutual Fund Analysis

- By AlternativeSoft

- July 2024

The landscape of mutual fund investments is becoming increasingly complex, requiring institutional investors to utilize advanced data aggregation and analytics tools to maintain a competitive edge. This article explores how leveraging comprehensive data aggregation can enhance mutual fund analysis, improve decision-making, and ultimately boost returns.

Enhancing Hedge Fund Strategy with Predictive Analytics

- By AlternativeSoft

- June 2024

Hedge funds are characterized by their diverse strategies and unique risk-return profiles, making them a challenging asset class to master. This article examines how predictive analytics can enhance hedge fund strategy, providing institutional investors with actionable insights to optimize their investment decisions.

Did Hedge Funds with a Long Track Record Perform better in 2023?

- By AlternativeSoft

- Apr 2024

2023 was a remarkable year for financial assets. USA inflation rates started to decrease from 6.45% in 2022 to 3.5% in 2023 [1]. Both the equity and fixed-income markets saw a strong rebound after the significantly bearish conditions of 2022.

Skill or Luck? What Role does the Macroeconomic Cycle Play in CTA Performance?

- By AlternativeSoft

- Aug 2023

In this article, we aim to explore this relationship, shedding light on the extent to which economic fluctuations influence hedge fund managers’ outcomes. We focus on a specific hedge fund strategy, the Commodity Trading Advisor (CTA), and analyze its performance during distinct macroeconomic cycles over the past two decades.

Hedge Funds Exposure to the Banking Sector

- By AlternativeSoft

- June 2023

The recent banking failure in the USA, as evidenced by the collapse of Silicon Valley Bank (SVB) and First Republic Bank in March 2023 and the takeover of Signature Bank by federal authorities in May 2023, has sent shockwaves through the financial markets, affecting various sectors and institutions.

Hedge Funds Heatmap using AlternativeSoft

- By AlternativeSoft

- Feb 2023

Check out our latest analysis on the Hedge Funds Heatmap using AlternativeSoft's analytical platform and With Intelligence's hedge funds data. Our data-driven approach investigates whether the sector has grown or contracted in light of economic and geopolitical factors. Explore the complete heatmap and gain valuable insights for informed investment decisions in the hedge fund space.

How to select the 8 largest hedge funds for your pension fund portfolio

- By AlternativeSoft

- Feb 2023

We'll take you through the key factors to consider when making your investment decisions, and provide valuable insights into the performance and risk profiles of top hedge funds. Don't miss out on this essential guide to optimizing your portfolio for success. Watch the video now and take the first step towards building a winning investment strategy.

Seamlessly integrate hedge funds for a stronger, more balanced portfolio

- By AlternativeSoft

- Feb 2023

Our latest video is now live and ready to help you diversify your pension fund portfolio like a pro. Learn how to seamlessly integrate hedge funds for a stronger, more balanced portfolio. From risk management to due diligence, we cover everything you need to know to get started. Watch now and take your investments to the next level!

10 proven strategies to help you reach your financial goals

- By AlternativeSoft

- Feb 2023

Attention all investors! Are you looking to maximize your funds' investments? Here are 10 proven strategies to help you reach your financial goals. Remember, the key to maximizing your funds' investments is to have a well-thought-out strategy, stay disciplined, and avoid making impulsive decisions.

A Stress Test Analysis: What are the Most Resilient Hedge Funds Strategies?

- By Leila Majidizavieh

- Jan 2023

Although the federal reserve has not yet announced a recession, the U.S. economy has slowed significantly in terms of the rate of real GDP growth compared to the previous year. Lower disposable income and higher interest rates are respectively reflected in lower spending and weakening housing sector activity.

Are hedge funds with a long history of their managers' experience performing better?

- By Leila Majidizavieh

- Nov 2022

2022 has been an extraordinary year thus far for financial assets. With a new recession in the very near future, investors are questioning whether hedge fund managers have enough experience to weather the storm. Is it the case that those funds whose managers have experienced previous crisis periods will perform better throughout the new crisis period?

Russia-Ukraine Conflict: Has it changed the performance of Hedge Funds?

- By Leila Majidizavieh

- Sept 2022

Disruptive events such as wars generally alter the risk and return characteristics of asset classes. These events also change asset class correlations and the way asset managers set their asset allocation strategies. The Russia-Ukraine conflict has significantly affected the world’s financial markets. Subsequentially, one would expect hedge fund returns to be impacted.

Crypto Hedge Funds: Are they worth it?

- By Leila Majidizavieh

- Aug 2022

Crypto assets have been amongst the fastest-growing asset classes in recent years. This new asset class has attracted a diverse set of investors, ranging from traditional institutional investors to more nascent investors keen to play a role in the innovation and transformation that blockchain technology promises.

Are Investors Sleeping on Hedge Funds

- By Ben Nuttall

- July 2022

We wanted to know whether investors are using hedge funds as a way to consolidate their portfolios in response to the equity, bond and crypto downturns throughout 2022. In our latest article, we analysed the inflows and outflows of the global hedge fund market, and found that investors are not moving to hedge funds in the way many might have expected.

100 Funds Delivering Positive Returns During Inflationary Period

US inflation has reached +8.3% and the S&P500 and crypto markets are down -20% and -40% for 2022, respectively. The question many institutional investors are asking is where and how to allocate funds to achieve positive returns in the next five to ten years, given the growing long-term inflationary challenges?

With inflation and interest rates rising and equity markets showing signs of instability, are CTA's still relevant?

In light of signs of equity market instability, investors are increasingly exploring Commodity Trading Advisor (CTA) funds for alternative returns. We explore the portfolio impacts of CTA allocations in our latest applied research.

Bank of England rate hikes: An analysis of the consequences on a European Portfolio

- By AlternativeSoft

How can an investor use state-of-the-art analytical tools to protect themselves, and profit, against rate hikes? In this article we use AlternativeSoft to analyse the impact of the Bank Of England rate increase on a typical European allocator portfolio and evaluate different strategies to hedge the portfolio against potential future rate hikes.

Turbulence in Europe hedging a European portfolio from Ukrainian war strategies

AlternativeSoft has added a hedge fund allocation to a traditional portfolio to see if extreme risk can be hedged during a crisis period. The current war in Ukraine has impacted global commodity prices and we theorize that CTA / Managed Futures may improve extreme risk management in portfolios.

CTA Hedge funds: when is the right time to enter? A comparison of Momentum and Contrarian strategies

With inflation and interest rates rising and equity markets showing signs of instability, investors are increasingly looking at Commodity Trading Advisor (CTA) funds as an alternative source of return. CTAs aim to achieve their investment objectives through the trading of futures. Therefore this begs the question; when is the right time to enter? Check out a comparison of momentum and contrarian strategies here:

Portfolio Construction - Investment Strategy, Simplified

How can fund investors use intelligent solutions to simplify the allocation decision-making process? In our latest article, AlternativeSoft explores how our bespoke portfolio construction solutions empower simplify allocation decisions with award-winning analytics.

Ulcer Index and Serenity Ratio: Can they help to select better performers?

In this article we will evaluate the usefulness of the Ulcer Index and Serenity Ratio when selecting funds. We will first explain the two metrics and how are they related and then evaluate to what extent Serenity Ratio can outshine the Sharpe Ratio when selecting best performers.

Market-Neutral Hedge Funds During Crisis

Market-neutral funds are actively managed to be independent from both upward and downward market movemements. Usually, this is achieved through the use of paired long and short positions. These funds can potentially serve to mitigate market risk as they seek to generate positive returns in all market environments.

The Rise and Fall of Evergrande Group

As investors watch the Asian markets, we take a closer look at Chinese real estate. AlternativeSoft allows investors to ascertain fund exposure levels and decompose portfolio risk and return to help mitigate the impact of such events on institutional portfolios.

How to tackle Heteroskedasticity when analysising returns

Style analysis is widely used in the Alternatives Industry to estimate the exposure of less transparent funds. To explain fund return streams, there is a commonly used regression technique called Ordinary Least Square (OLS). In this article, learn about the issue of Heteroskedasticity, how to account for it in OLS analysis and modeling.

Hedge Fund Portfolio Diversification

Can investors maintain a well diversified portfolio, even during crisis periods? In this article, AlternativeSoft measures the impact of the Covid-19 pandemic on the correlation of hedge fund index returns. Which strategies maintained the lowest correlation to other indices throughout the crisis?

Understand your moments

- By AlternativeSoft

Mean return and variance measures are fundamental to analysing hedge funds. But in which scenarios is it more prudent to introduce higher-moment models such as co-skewness and co-kurtosis to inform your investment decisions?

Is Asset Skewness a good indicator of future returns?

In this article, we analyse if skewness can be a useful indicator of future performance for North American mutual funds.

We categorise the skewness of returns of 1,200 Equity based Mutual Funds into 6 portfolios, based on their performance between 2000 and 2010.

Drawdown-adjusted VaR optimisation vs Modified Value at Risk optimisation in Hedge Fund portfolio construction

In this article we look at equity returns and the returns of top performing US equity Mutual Fund to show that increasing yields has a tangible effect on equity and mutual fund performance. We also show that by holding the top 10 invested stocks for this fund you can out-perform the entire portfolio.

Top 10 European hedge funds based on performance between April 2020 and March 2021

We find that Edale Europe Absolute Fund has been the best performing European Hedge Fund after the COVID-19 Financial shock that took place in March 2020. In this article we rank European Hedge Funds by their cumulative returns between April 2020 and March 2021.

Rachev Ratio: How is it calculated and does it help to prevent drawdowns?

The Rachev ratio provides an alternative measure for an investment's risk-return performance by dividing the average of right tail returns by the average of left tail returns at given percentiles equidistant from the mean. In this article AlternativeSoft evaluates whether the Rachev Ratio can be used to avoid significant drawdowns.

How did the American Long/Short Hedge Funds performed compared to Chinese ones in 2020?

We selected Hedge Funds with AUM greater than $10 Million, with an investment geography focus in China and United States.

59 funds from China and 210 funds from the United States got selected for the analysis on which a weighted index was created based on the hedge funds’ AUM.

How to compare performance of Hedge Fund strategies using NilssonHedge data?

We find that Hedge funds investing in Crypto have had the highest Annual Sharpe Ratio between 1st of March 2020 and 31st of March 2021. AlternativeSoft analysed and compared 1563 Hedge Funds of the NilssonHedge database between the time period 1st March 2020 to 31st March 2021.

Effect on positions concentration in the top ranked US Mutual Fund during 2020

In this article we look at equity returns and the returns of top performing US equity Mutual Fund to show that increasing yields has a tangible effect on equity and mutual fund performance. We also show that by holding the top 10 invested stocks for this fund you can out-perform the entire portfolio.

Which mutual funds and hedge funds with AUM>100m USD performed the best since March 2020 Covid-19

This brief article examines the five best performing Hedge Funds and the five best performing Mutual Funds from April 2020 to December 2020. The sole focus was placed on hedge funds and mutual funds that have AUM > USD100m.

What have been the best investments for Bridgewater in Q3 2020?

Bridgewater Associates is the world’s biggest hedge fund. Founded in 1975 by Ray Dalio , it grew exponentially throughout the decades, and it now serves individuals, institutions, trusts, private funds, charitable organizations, and investment companies offering portfolio management...

Did hedge funds with historically high Annual Sharpe Ratio outperform the average hedge funds during March 2020

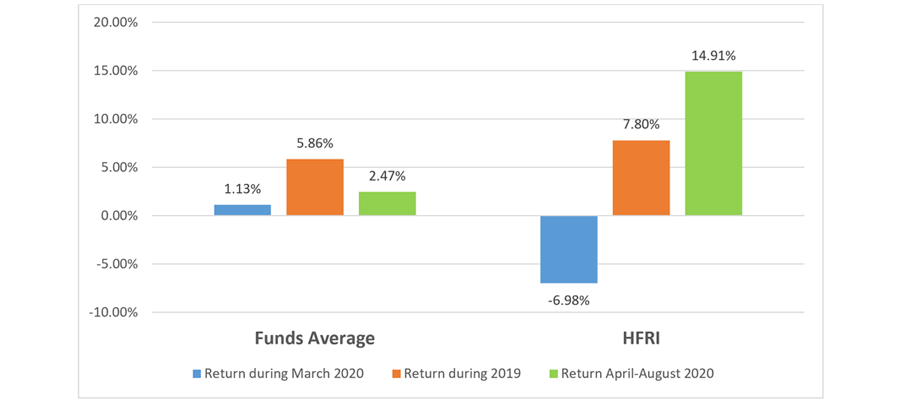

We selected 32 hedge funds with an Annual Sharpe Ratio greater than 4 during the period Jan2010-Feb2020and with at least $10M of assets under management.

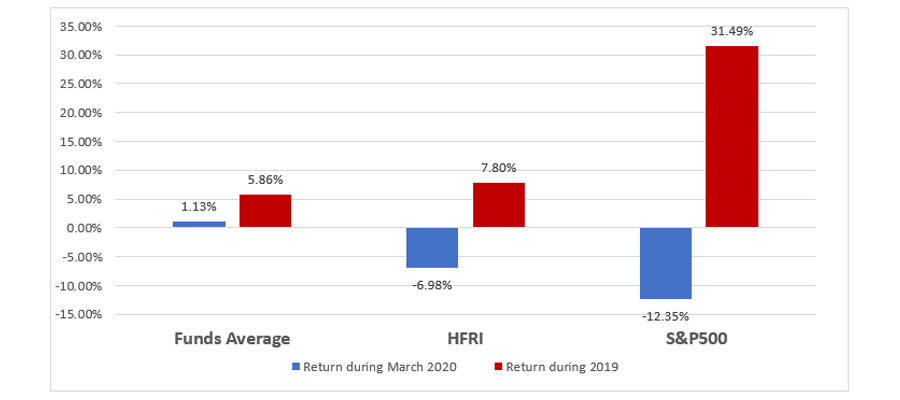

Bearish Returns Opportunity

This analysis uses 836 CTA (Commodity Trading Advisor) Hedge Funds and compares their returns in March 2020 and for the year 2019. Data for these funds are provided by NilssonHedge, EurekaHedge and HFR.

Moves to long-only investing increase demands

As the industry witnesses fading differentiations between long-only, private equity and hedge funds, investors are starting to purchase software and databases.

Reducing Drawdown Using Alternatives

Does investment in an active manager provide better drawdown protection than investment in the market?

Analysing 2018 Hedge Fund Performance

Was 2018 really as bad a year for Hedge Funds as most market commentators have suggested and, if so, which strategies would have been best insulated from the turbulence?

Fund Selection Using Alternative Statistics

Can we find outperformance using an algorithmic asset selection approach which focuses on lesser used risk and return statistics?

Office Location

UK: 10 Lower Thames Street, London

EC3R 6AF

USA: 200 South Wacker Drive, 31st Floor,

Office 3214, Chicago, IL 60606