Fund Investing,

Simplified

Used by institutional investors

investing in Mutual Funds, Hedge Funds & Private Market

Funds

Our platform powers investment decisions for the world’s top asset managers and hedge funds.

Trusted by leading institutional investors, AlternativeSoft delivers award-winning risk management and portfolio analytics solutions. Our powerful platform simplifies complex data, helping you optimize investment strategies and make informed decisions with confidence.

Seamless Funds' Database – Aggregate funds from Bloomberg, Morningstar, Albourne, eVestment Nasdaq, Pitchbook, HFR, Preqin and more into one platform.

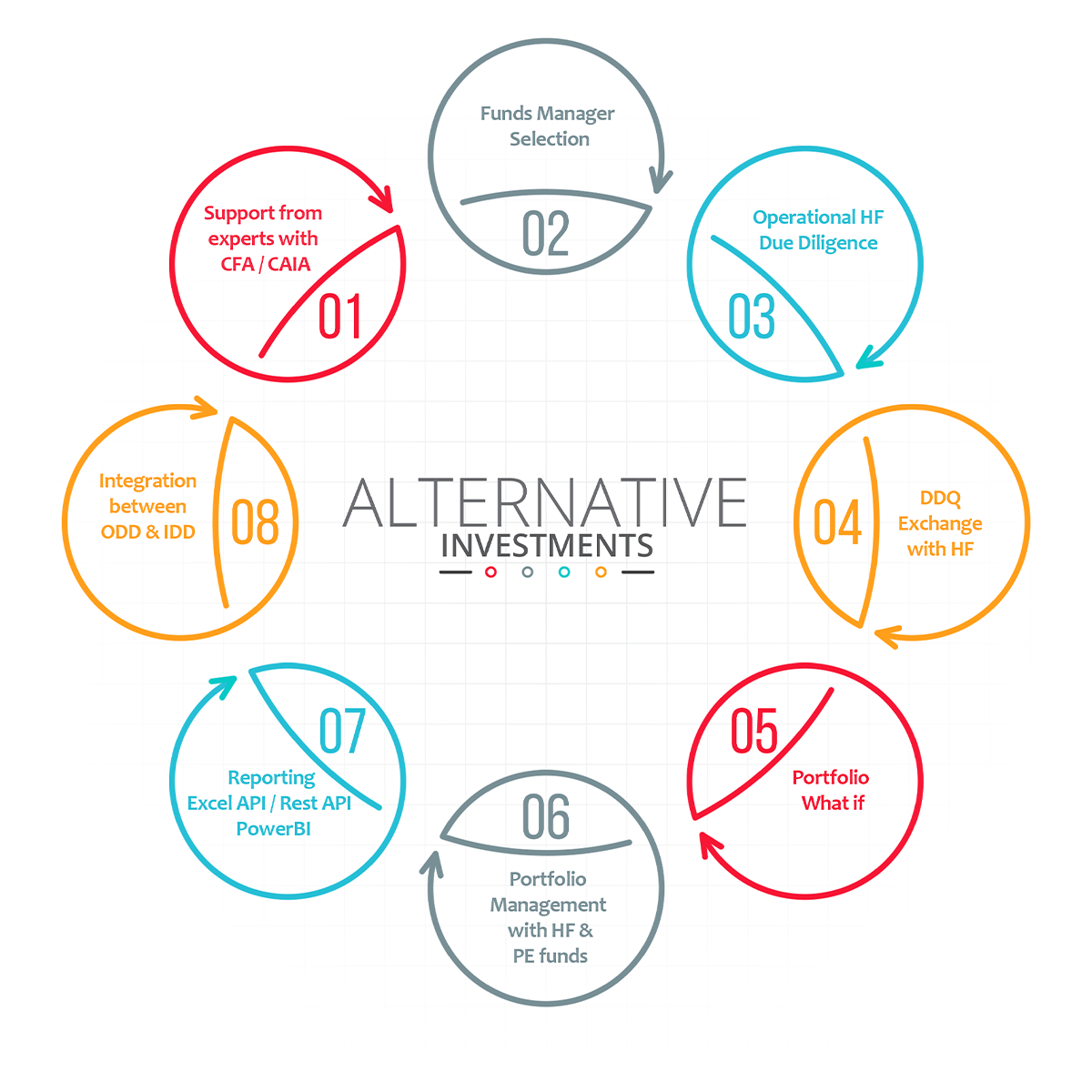

Interactive Due Diligence – Combine qualitative and quantitative manager insights for a holistic view.

Optimized Portfolio Construction – Leverage cutting-edge analytics to design and refine portfolios.

Advanced Fund Selection – Define your investible universe with precision.

Discover the power of AlternativeSoft—where data meets intelligent investing.

Since 2005, AlternativeSoft has simplified fund selection and portfolio construction for institutional investors. Our platform combines data from sources like Bloomberg, Morningstar, eVestment Nasdaq and Preqin to help users build and manage funds and portfolios in one single SQL database.

Key features:

Analyze manager performance with 4000+ statistics

Screen and define investible universe

Monitor fund exposures

Build and test portfolios

Conduct fund due diligence

Trusted by global institutions managing over $1.5tn in assets, including pension funds, family offices, and wealth managers, for analyzing multi-asset portfolios of hedge funds, mutual funds, ETFs, and private market funds.

But don’t just take our word for it—get access to your free trial today and see why clients have voted us Hedgeweek's Best Risk Management software for 4 years running!