AlternativeSoft offers valuable insight into how a manager’s funds are being perceived by end investors.

AlternativeSoft provides cutting edge analytics and statistics to identify peer group outperformance and highlight these opportunities to potential allocators through customisable reports.

View how allocators assess fund performance against peers and industry benchmarks.

Choose data from a wide variety of sources and create bespoke factsheets highlighting outperformance through chosen parameters and display these statistics in a highly flexible format.

Distribute these customisable factsheets over multiple platforms and raise interest and assets through more transparent and focused communications with your existing and new investor client base.

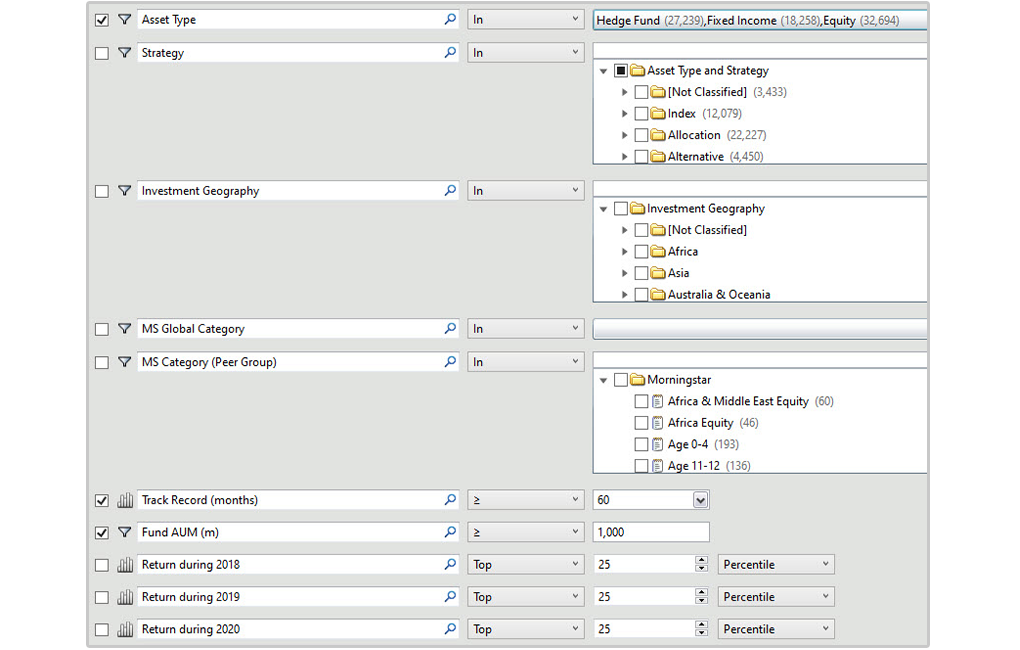

Ensure your manager research teams are monitoring the best funds on the market with the best fund selection software. Whether it is monitoring new launches or benchmarking established names against peers, AlternativeSoft's fund reporting software has proven to be the most comprehensive tool for all your fund analysis needs.

Take the strain out of reporting. With AlternativeSoft’s fund reporting software and the use of our Excel API, it’s never been easier to quickly recreate the analysis you need to ensure you stand out from the crowd.

Aggregate data across multiple databases, remove duplicates, and see the most up-to-date time-series data and statistics for funds. Use this data with open source or in-house libraries for more complex analysis via our rest API.

71 Carter Lane, London,

EC4V 5EQ

+44 20 7510 2003