Analyze. Manage. Succeed.

Book a Free Consultation Explore Benefits

Discover the cutting-edge financial strategies trusted by allocators for 5 of the 10 largest hedge funds globally. See how we’ve simplified these solutions to make portfolio management smarter, more efficient, and accessible for your investment needs.

Utilize advanced algorithms and accurate data to calculate returns and manage risks with precision.

Benefit from in-depth portfolio analysis that covers all aspects of performance and risk management.

Enhance your investment strategy with tools designed to optimize returns and manage risk effectively.

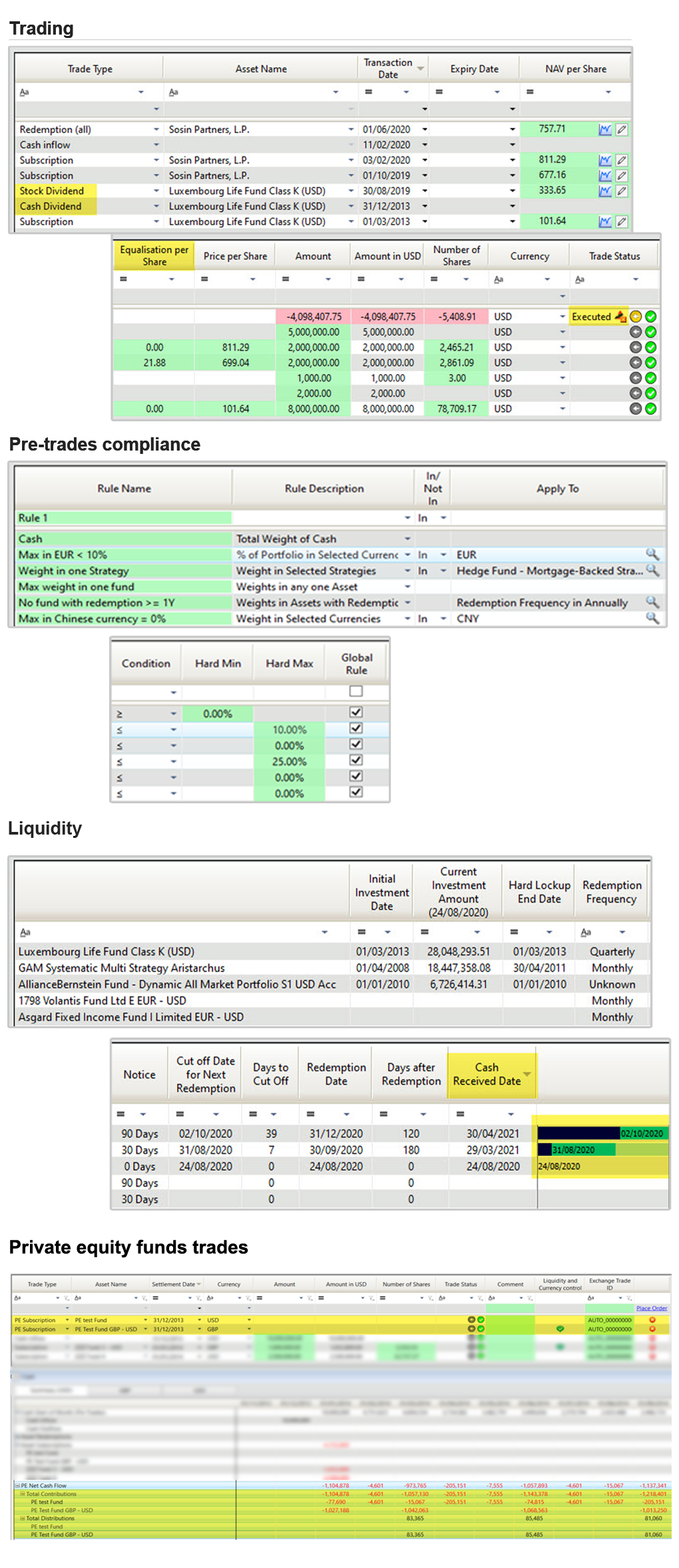

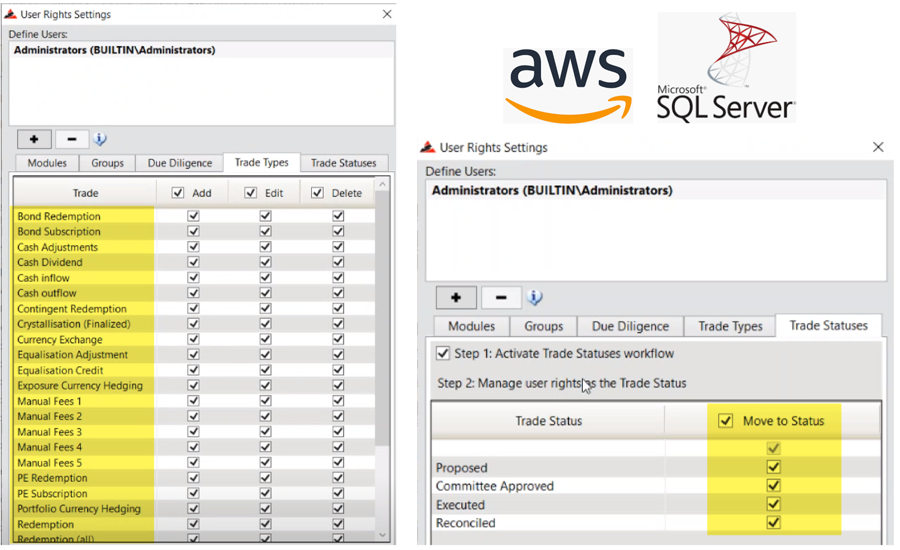

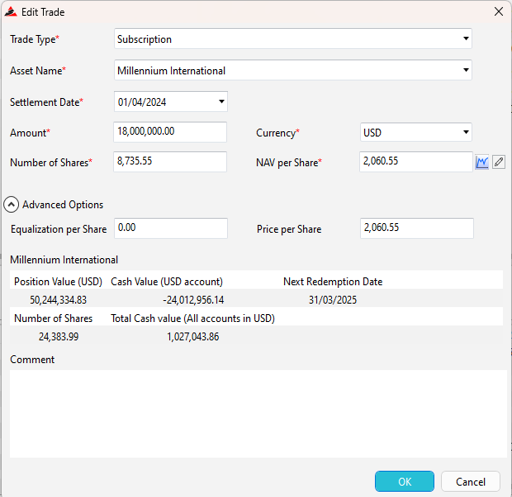

Middle Office

AlternativeSoft streamlines many useful performance based analytics including portfolio optimization, peer evaluation, and relative analyses.

AlternativeSoft's software solution is one of the most easiest softwares for portfolio whatif and customised fund fact sheets that I have ever handled.

AlternativeSoft is a practical and user friendly tool used as part of our portfolio construction and risk management process. Their extensive support and responsiveness provides added value.

From statistical analysis on a single hedge fund, screening the investment universe, peer group analysis, FoHF portfolio construction to risks analysis and stress testing, AlternativeSoft is one of the most effective, intuitive, and efficient tool I have handled..

At AlternativeSoft, we take pride in what our clients have to say. But our commitment doesn't stop at praise. Discover how our services can transform your investment strategy.

The most comprehensive funds' aggregator on the market.

Screen your database, categorise & find alpha.

Benchmark a fund against thousands of peers.

Calculate sensitivity to factors & manager skill.

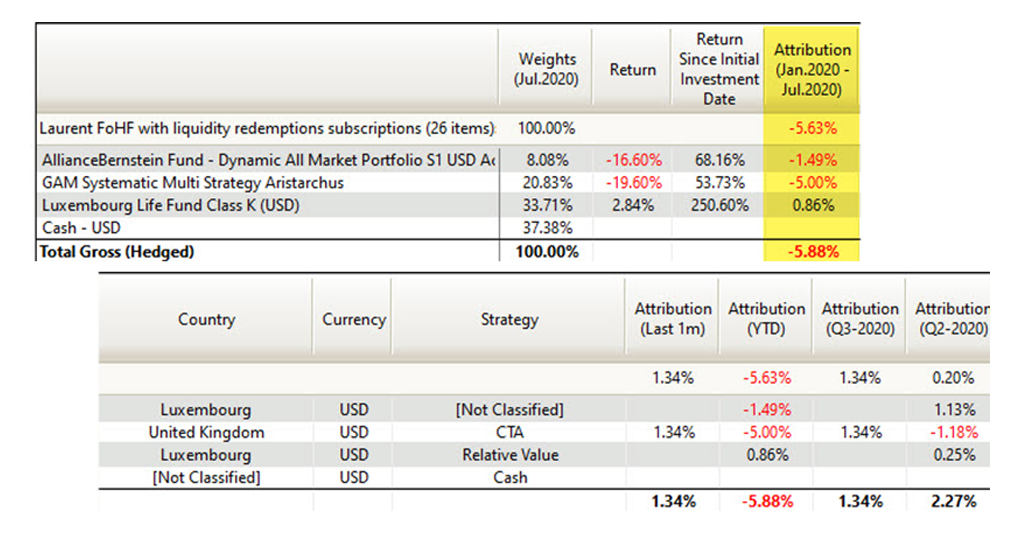

Calculate portfolio returns attribution buy & sell funds.

Build portfolios and measure their current risks.

Add a more deep dive analysis into your existing dashboards, and your existing reports.

Complete RFPs, RFIs, and questionnaires to one easy-to-access platform.

Discover new hedge funds and reach 160 institutions in hedge funds, promote your hedge fund.

Delve into our Knowledge Center for valuable resources, including brochures, case studies, and research articles, designed to enhance your understanding of the investment landscape.

Explore our Investment Due Diligence brochure to learn about our rigorous methodologies and how we can help you make well-informed investment decisions.

Read More!Discover how our tailored solutions helped a Swiss Family Office achieve their financial goals and gain a competitive advantage in today's complex investment landscape.

Read More!The hedge fund industry experienced a total net outflow of $37.1 billion in 2024, adjusted for the positive 2024 returns, but a deeper analysis reveals an unexpected pattern in capital movements that challenges conventional wisdom about investor preferences.

Read More!